Part 1: What is Trailing Stop Loss?

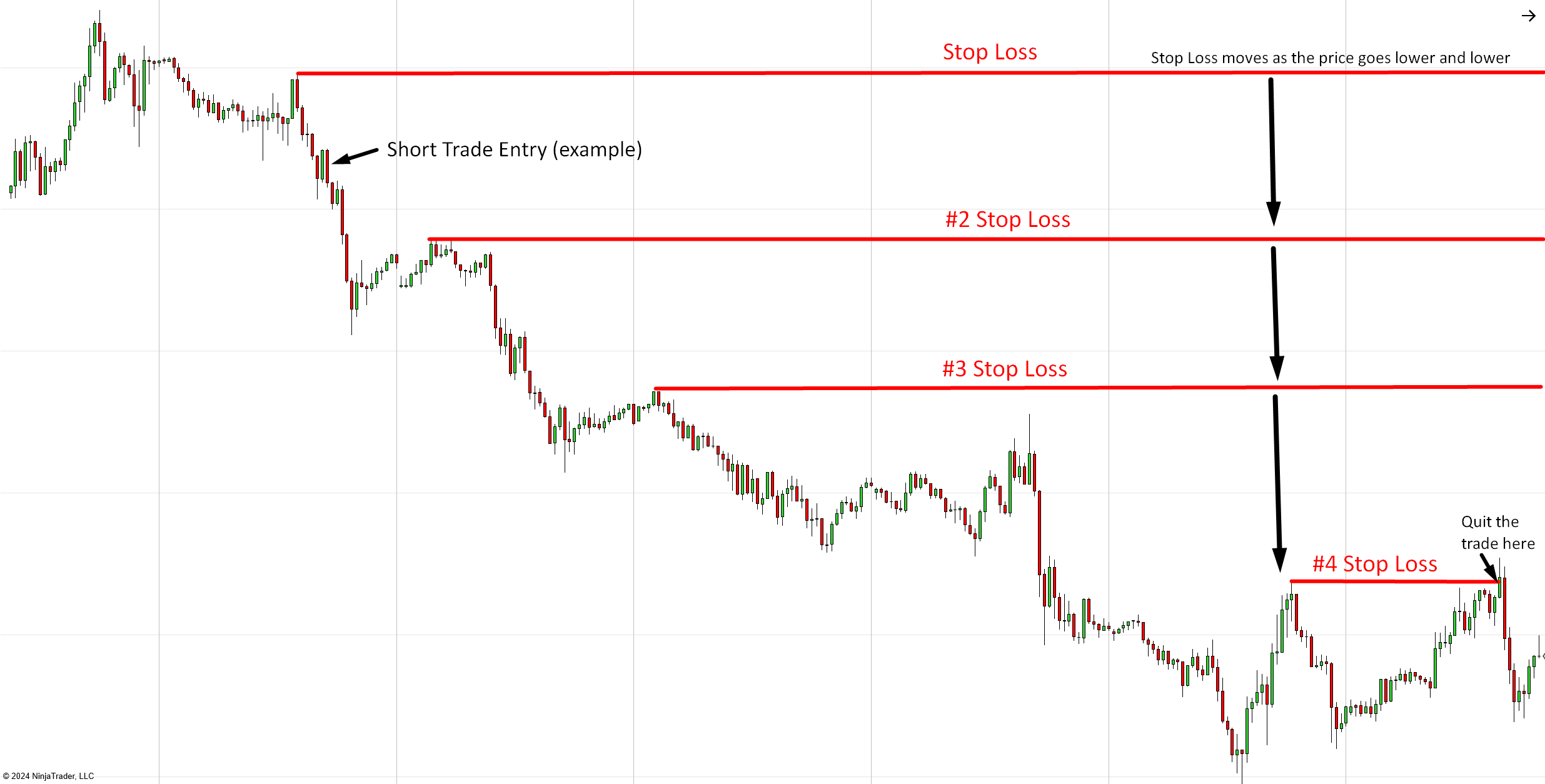

The concept behind trailing Stop Loss is simple: after entering a trade, you keep moving your stop loss as the market moves in your favor. This allows you to secure your position repeatedly, ensuring that you capture most of the trade’s potential profits. Ideally, you aim to catch a trend and ride it as long as possible, adjusting your Stop Loss to lock in gains along the way.

It’s a method to gain the maximum from a big market movement while keeping losses under control.

So, that’s the theory. But how’s the reality?

Part 2: The Longer You Stay, The Bigger the Risk

While staying in a trade can yield significant profits, it also comes with increased risks. The longer you’re in the trade, the more you expose yourself to unpredictable factors such as changes in market sentiment, macroeconomic news, or sudden volatility spikes. These unforeseen events can quickly turn a profitable trade into a losing one.

The essence of trailing your stop loss is to remain in the trade as long as possible, capturing big profits. However, this approach has its downside. The longer you stay, the greater the chance that something unexpected will happen, potentially reversing the trend and wiping out your gains.

Part 3: Ignoring Barriers Can Cost You

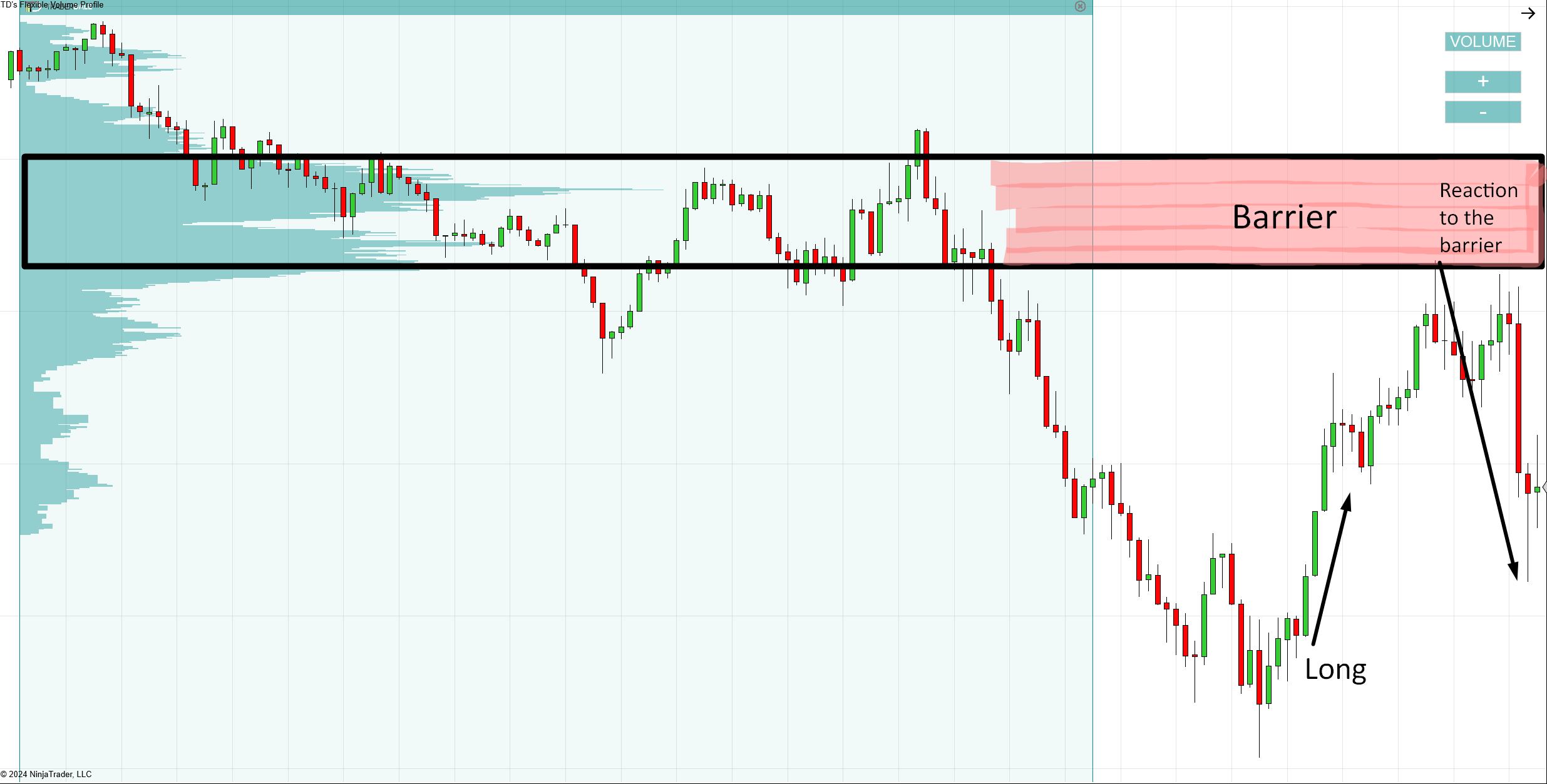

A common mistake traders make while trailing their Stop Loss is ignoring critical Support and Resistance levels. Many focus solely on trailing the Stop Loss without setting a fixed Take Profit. They aim to let the market decide where the trade ends. However, this approach often backfires when the price hits a significant barrier and suddenly reverses direction.

Support and Resistance levels act as barriers where price action can stall or reverse. If these levels aren’t considered, the market may kick you out of your trade prematurely, leaving you frustrated.

Instead, I recommend identifying these barriers on the chart and planning your trade around them to avoid unpleasant surprises. This means quitting your trade at those barriers (more on that later).

The picture below shows price reaching an important barrier – a heavy volume zone. If you were focusing just on trailing your Stop Loss, then this barrier would ruin your trade. However, if you were aware of this barrier and quit your profit there this would end up being a way better trade.

Part 4: Why Missing the Big One Doesn’t Worry Me

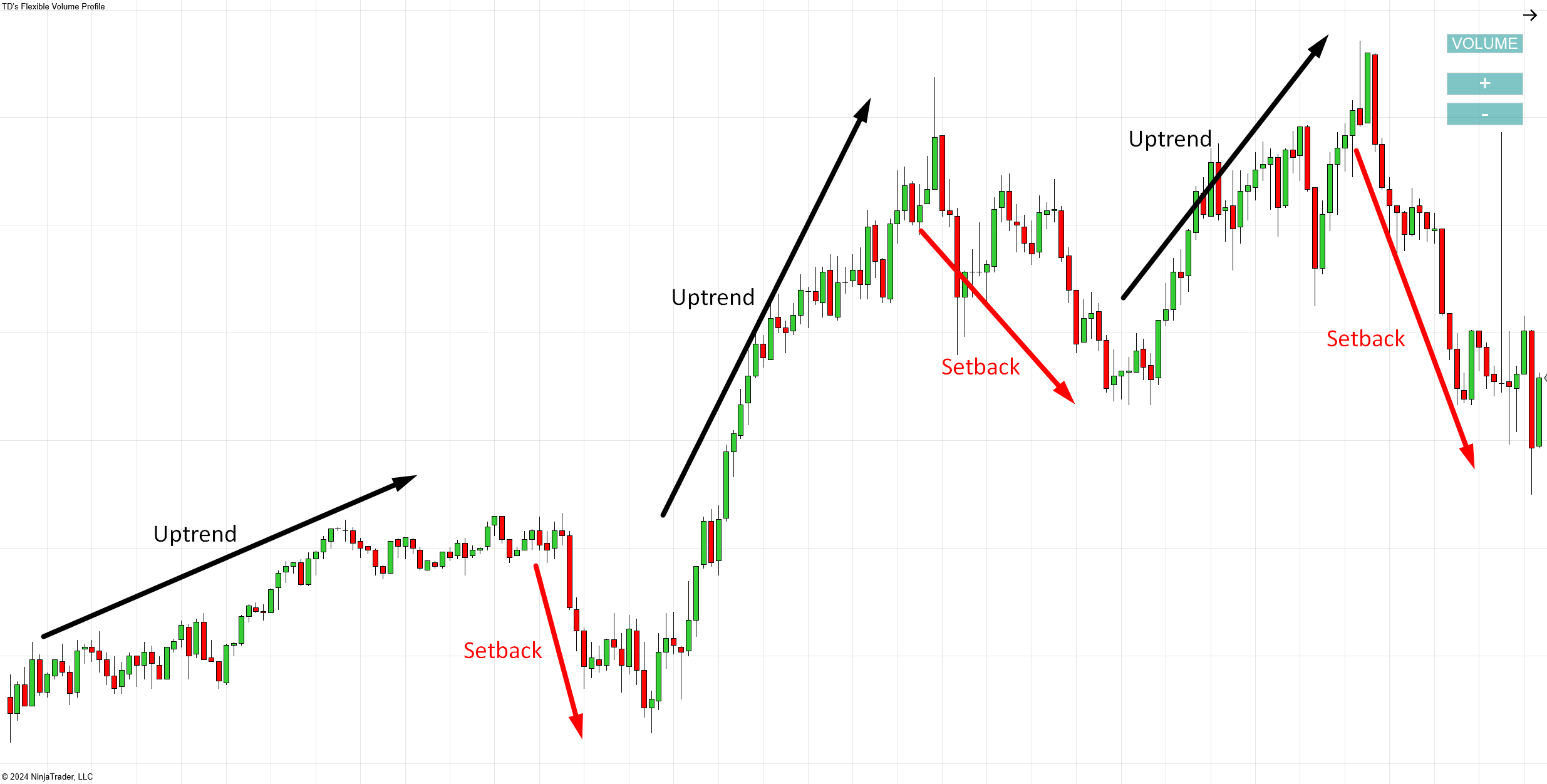

Many traders trail their stop loss with the hope of catching a massive trend. While the idea of riding a trend to a substantial profit is tempting, in reality, such opportunities are rare. More often than not, the market will throw curveballs—like sudden reversals, stop-loss runs, or sentiment shifts—that disrupt the trend and kick you out of your trade.

Institutional traders, or “big players,” often manipulate the market to take out liquidity by triggering stop losses. Even if the trend resumes, it rarely moves in a straight line. External factors such as macroeconomic news or volatility shifts add further complexity. Given these challenges, relying solely on trailing stop losses to catch big trends is in my opinion impractical. Instead, I recommend focusing on achievable and consistent profits, rather than trying to catch the “big one “.

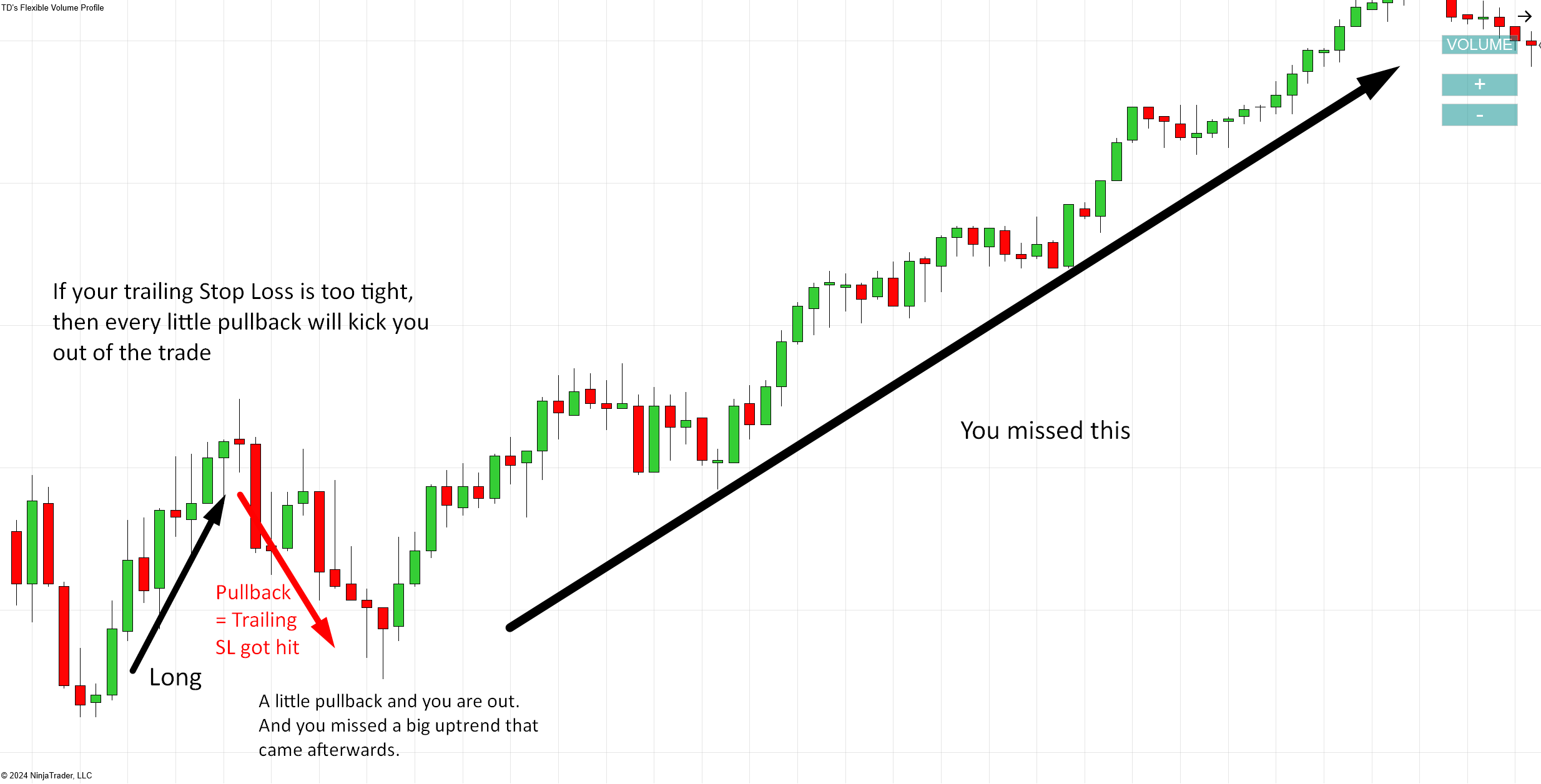

Part 5: The Dilemma of Stop Loss Size

When trailing a stop loss, finding the right balance is tricky. A tight stop loss minimizes potential losses but increases the likelihood of being kicked out of trades prematurely. On the other hand, a wide stop loss allows the trade more room to breathe and increases the chance of catching a significant trend. However, it also means you risk losing a substantial portion of your open profit if the trend reverses.

Striking the perfect balance between these extremes is nearly impossible. No matter what you choose, and how much you optimize your strategy, there will be moments when you wish your stop loss was tighter or wider.

There is no avoiding this, unless you use a bit different approach of stop loss placement – which I will show you a bit later in this article.

Part 6: My Recommendation for Take Profit Placement

Instead of relying solely on trailing stop losses and leaving the market to decide where you get kicked out of your trade, I recommend setting a fixed take profit based on strong support or resistance levels. These levels act as barriers where the price is likely to encounter challenges. By placing your take profit just before these barriers, you reduce the risk of the trade reversing and erasing your gains.

While this approach means you might miss out on the rare massive trend, the trade-off is worth it. Consistently securing profits at logical levels provides more reliable results than hoping for an exceptional trade that might never come.

Do you want ME to help YOU with your trading?

Part 7: My Recommendation for Stop Loss Placement

When placing a stop loss, avoid arbitrary methods like setting it a fixed number of pips behind the current price. Instead, base your stop loss placement on key barriers, such as swing points or high-volume zones identified using tools like Volume Profile or Order Flow.

Every time you adjust your stop loss, position it behind a barrier that serves as a shield for your trade. If the price breaks through this barrier, it’s a clear signal that the trade is no longer valid, and exiting the position is the right decision. This approach ensures your stop loss placement is strategic and aligned with market dynamics.

Part 8: A Practical Example

Here’s how you can combine these strategies:

- Enter the Trade: Identify a strong entry point using your preferred trading setup.

- Set a Fixed Take Profit: Place your take profit before a significant support or resistance level to secure your gains before the market encounters a potential barrier.

- Trail Your Stop Loss Strategically: As the trade progresses, adjust your stop loss manually, always positioning it behind key barriers such as swing points or volume clusters. These barriers act as your safety net.

By following this method, you’re protecting your trade while ensuring you capture reasonable profits.

Part 9: An Alternative Approach

Another effective strategy is using multiple take profits. Here’s how it works:

- First Take Profit: Secure a portion of your position early, ideally just before the price reaches the first significant barrier. This locks in some profit and reduces your overall risk.

- Second Take Profit: Position the remaining portion further away, near the next barrier. This allows you to participate in larger market moves while still securing some gains early.

This approach strikes a balance between capturing immediate profits and staying in the trade to capitalize on potential larger movements.

Conclusion

Conclusion- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment