DEFINITION:

Order Flow is an advanced charting software which enables you to read

all trading orders that are processed in the market. It helps to track

the BIG financial institutions through the trades they make.

Most people get confused when they open up a chart with Order Flow

for the first time. There is no shame in that. Order Flow shows so many

information and it is easy to get overwhelmed and confused if you don’t

know what to look for!

This Beginners Guide will teach you how to understand how Order Flow works and how you can use it in your trading!

In this 1st part of the Order Flow Guide I will show you around the Order Flow interface.

This Beginners Guide will teach you how to understand how Order Flow works and how you can use it in your trading!

In this 1st part of the Order Flow Guide I will show you around the Order Flow interface.

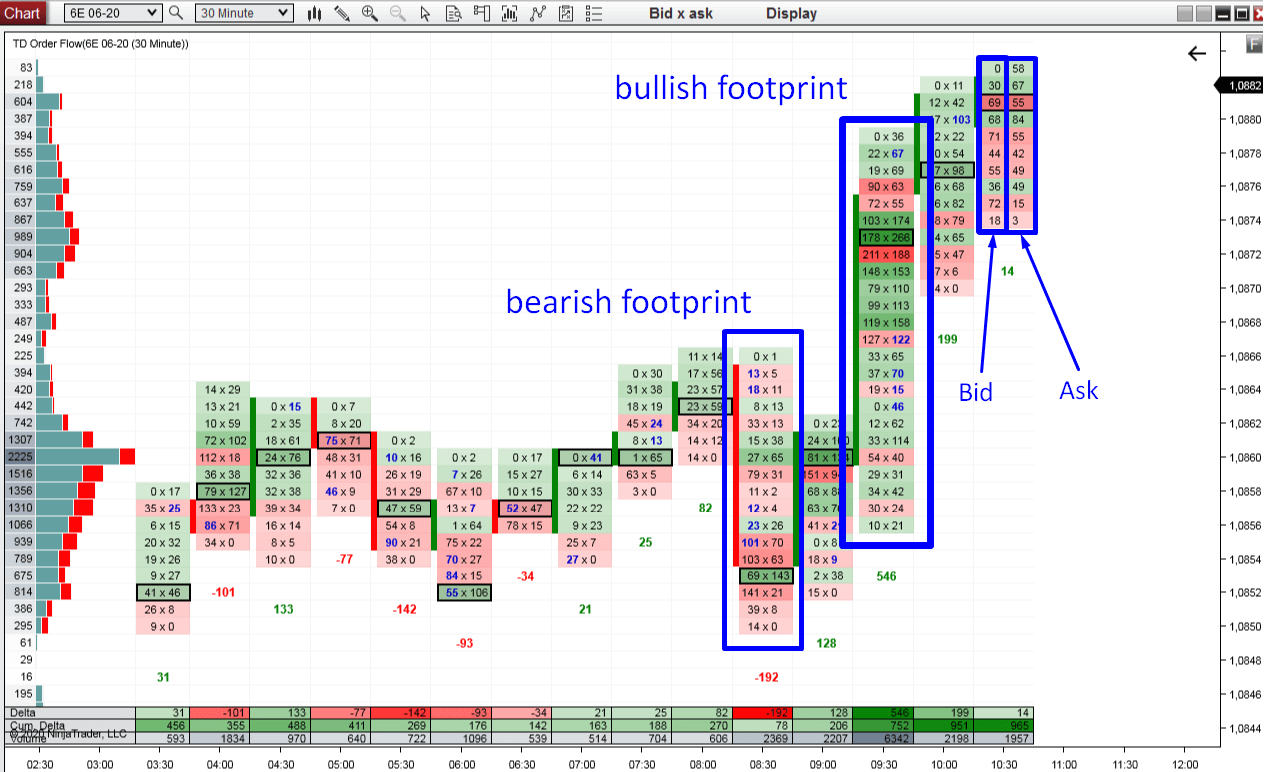

Footprints

The Order Flow does not show standard candles, but it shows FOOTPRINTS.A footprint shows not only Open, High, Low, Close (as standard candles) but it also shows orders traded in that candle.

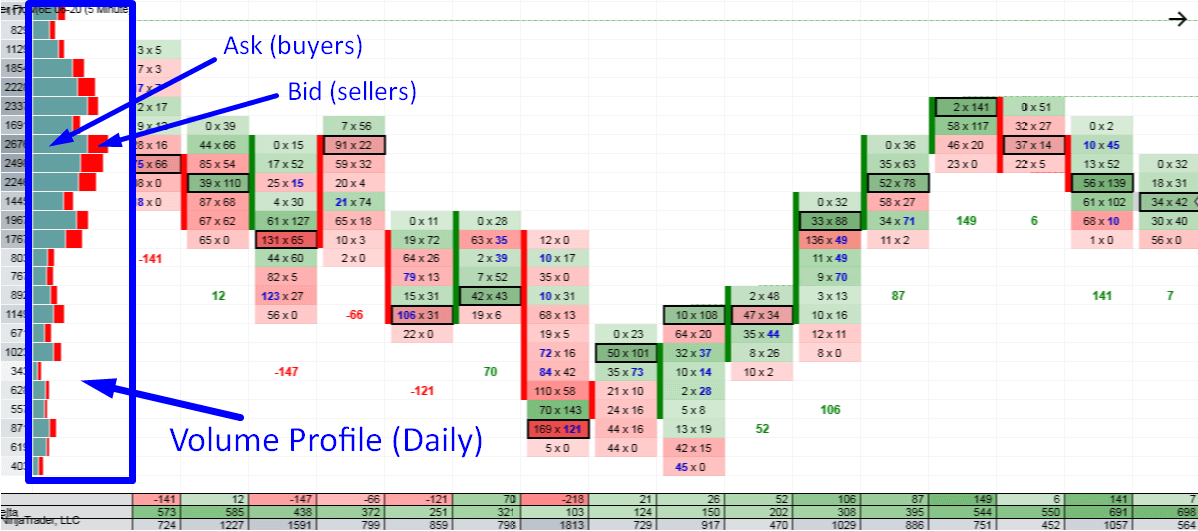

Orders can be placed on Bid or on Ask.

When a BUYER enters a long position (with a Market order), then his order shows on the ASK side of the footprint.

When a SELLER enters a short trade (with a Market order), then his order shows on BID.

This is how the Order Flow chart is drawn.

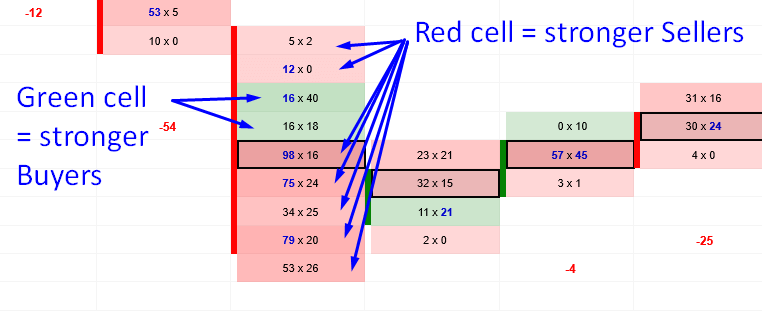

Green/Red Cells

Inside every footprint there are green or red cells.The cell is GREEN if the number on Ask is bigger than on Bid.

It is RED when the Bid is bigger than the Ask.

This represents the strength of Buyers versus Sellers.

For this reason, the bullish footprints are mostly green (stronger buyers) and the bearish footprints are mostly red (stronger sellers).

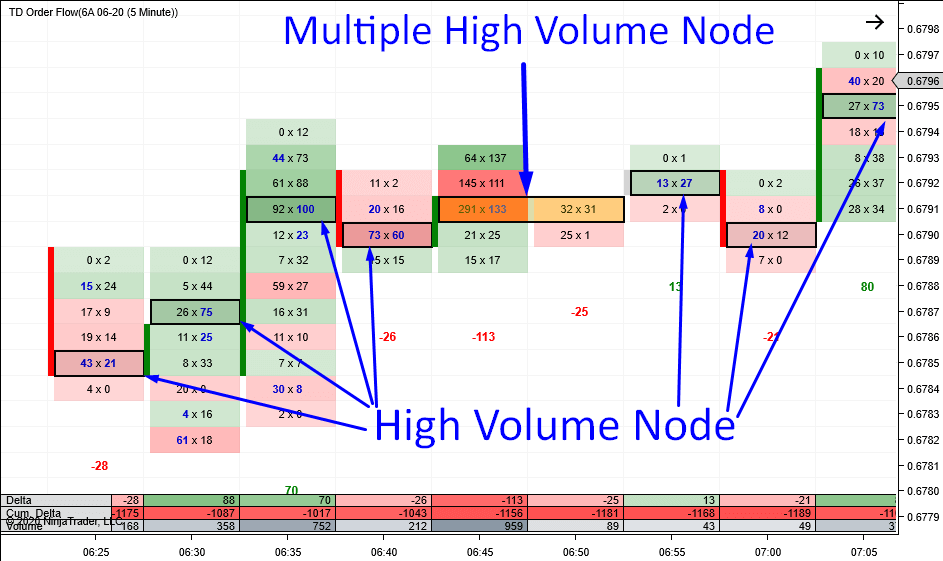

High Volume Nodes

Possibly the most important place in any footprint is the High Volume Node. It represents the place where the heaviest volumes were traded.It is marked by a black outline so it is easily visible at first sight.

If there are more Heavy Volume Nodes exactly at the same price and at least in two consecutive footprints then they are highlighted in yellow. Price levels like these represent a S/R zone.

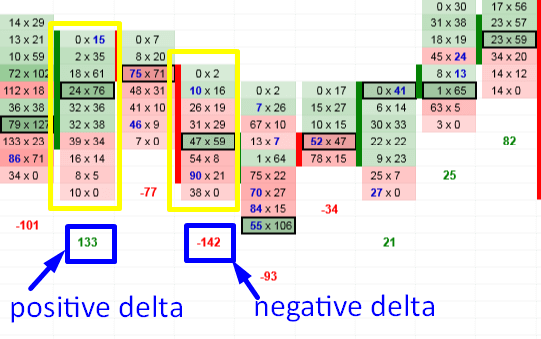

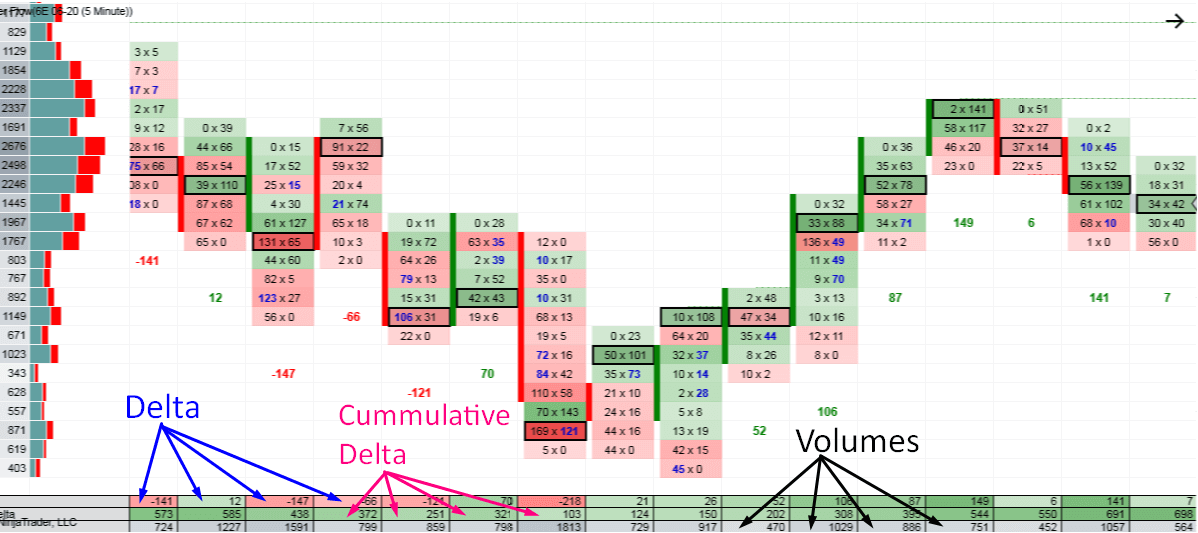

Delta

Below each footprint, there is a number which is either green or red.It is GREEN (positive) when there are more trades executed on Ask (in that whole footprint).

It is RED (negative) when there are more trades executed on Bid (in that whole footprint).

This basically tells you who is stronger in that footprint – whether buyers or sellers.

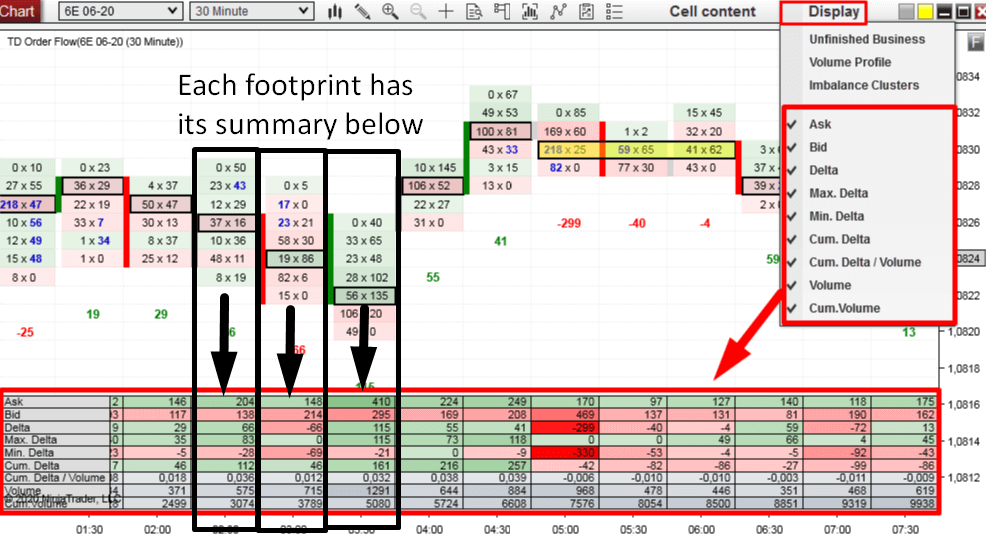

Footprint Summary

The panel at the bottom shows summary of each footprint.You can set it up any way you want so it shows the information you need to keep track of with your strategy. It is best not to have too much summary info there and only focus on a few most useful things.

I personally like to use only Delta, Cumulative Delta and Volume.

Delta shows whether there were stronger Buyers or Sellers.

Cumulative Delta shows delta changes throughout the whole day.

Volume shows the overall volume of each footprint.

The screenshot below shows my Summary settings:

Delta shows whether there were stronger Buyers or Sellers.

Cumulative Delta shows delta changes throughout the whole day.

Volume shows the overall volume of each footprint.

The screenshot below shows my Summary settings:

Volume Profile

My Order Flow software has also its own Volume Profile.It is a Daily Volume Profile which shows the volume distribution throughout the whole day.

This is really important feature because it shows you the bigger picture. And you always need to keep in mind the bigger picture when trading with the Order Flow!

The BLUEISH color on the Volume Profile represents orders traded on Ask (Market Buy orders) and the RED color represents orders traded on Bid.

Where to get Order Flow?

You can get my custom made Order Flow here:

TD Order Flow software & Training

You can get it as a part of OF Package which consists of:

Or you can get is as a standalone software product.

Happy trading!

-Dale

TD Order Flow software & Training

You can get it as a part of OF Package which consists of:

- Order Flow software

- Order Flow Video Course (12 hours long)

- Volume Profile Pack

Or you can get is as a standalone software product.

Happy trading!

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment