Hello guys,

yesterday, I did a video analysis on the EUR/USD. If you missed it, then you can watch it here:

EUR/USD: Volume Profile, Order Flow, and Price Action Analysis

Today, I would like to have a closer look at the AUD/JPY.

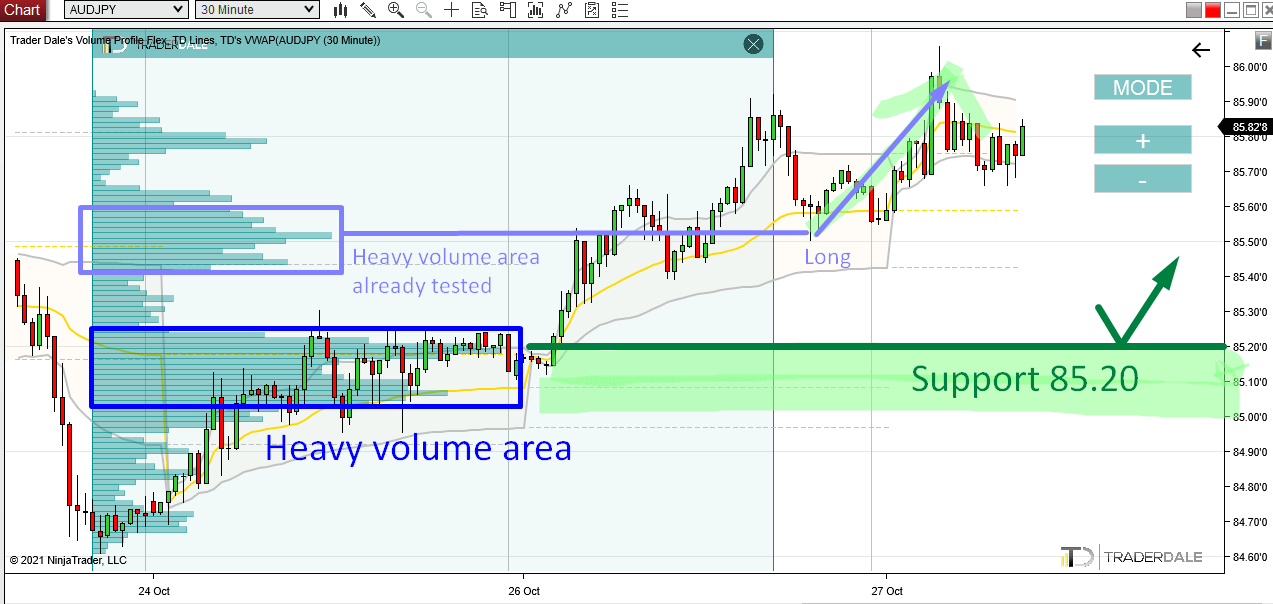

Since Monday, there has been an uptrend on AUD/JPY. When there is a trend I always like to trade pullbacks to heavy volume zones.

What I do is I use my Flexible Volume Profile and use it on the whole trend area. This nicely reveals the most important institutional trading zones. Those are the ones where the Volume Profile is the widest = heavy volume areas.

The price tends to react to those heavy volume areas – they work as strong Support/Resistance zones.

Why they work as S/R zones? Because the BIG guys (institutional traders) who were trading there in the first place defend those zones. They placed heavy volumes there before and this tells us that those zones are important for them. That’s why they defend them (by pushing price away from them) and why they work as strong Support/ Resistance zones.

Supports on AUD/JPY

There are two such heavy volume zones on AUD/JPY.

The first one around 85.50 got already tested and there was a nice reaction to it.

However, there is also a second heavy volume zone around 85.20 and this hasn’t been tested yet. This means it should work as a Support. The same way the zone around 85.00 did.

When the price makes it back to 85.20 I expect the BIG guys to defend this zone and to push the price upwards from there again.

AUD/JPY; 30 Minute chart:

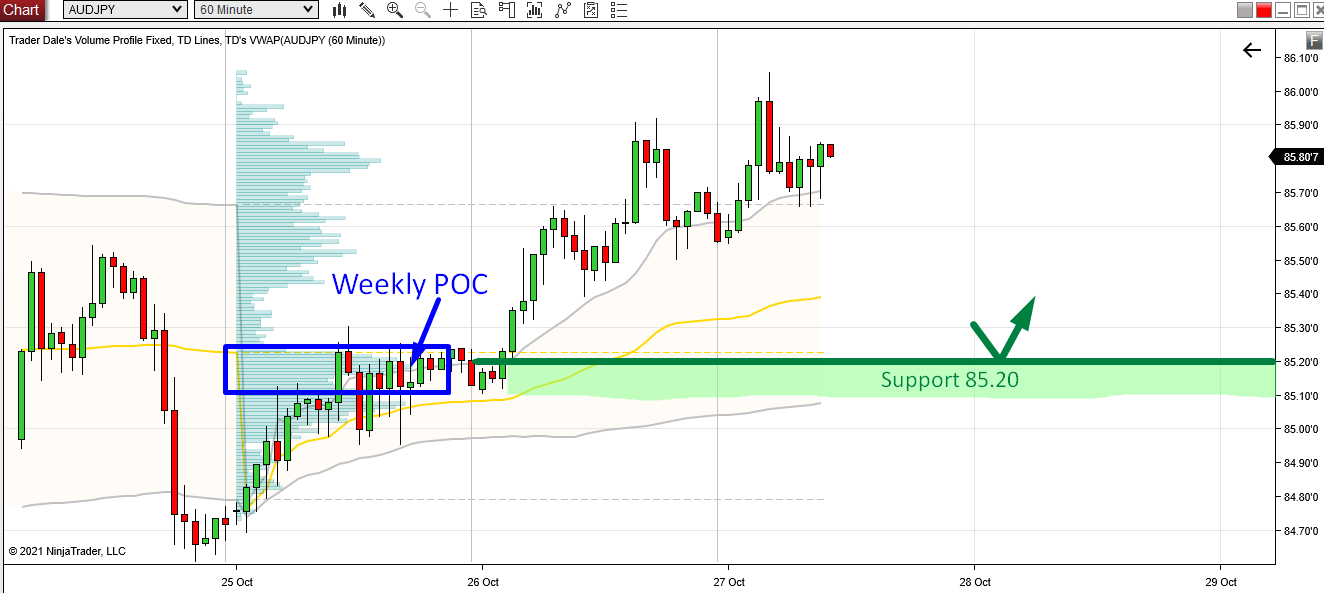

Weekly POC

Another thing I like about the 85.20 area is that it is a Weekly Point Of Control (POC). This means that the heaviest volumes throughout this week (so far) have been traded there.

This is just by itself a very important level to be aware of.

AUD/JPY; 60 Minute chart:

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

P.S. The setup I used here is one of my favorite Volume Profile setups called the “Trend Setup“. You can learn all there is about it in my Volume Profile trading course.

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment