Hello guys,

today, I am going to talk about EUR/CHF.

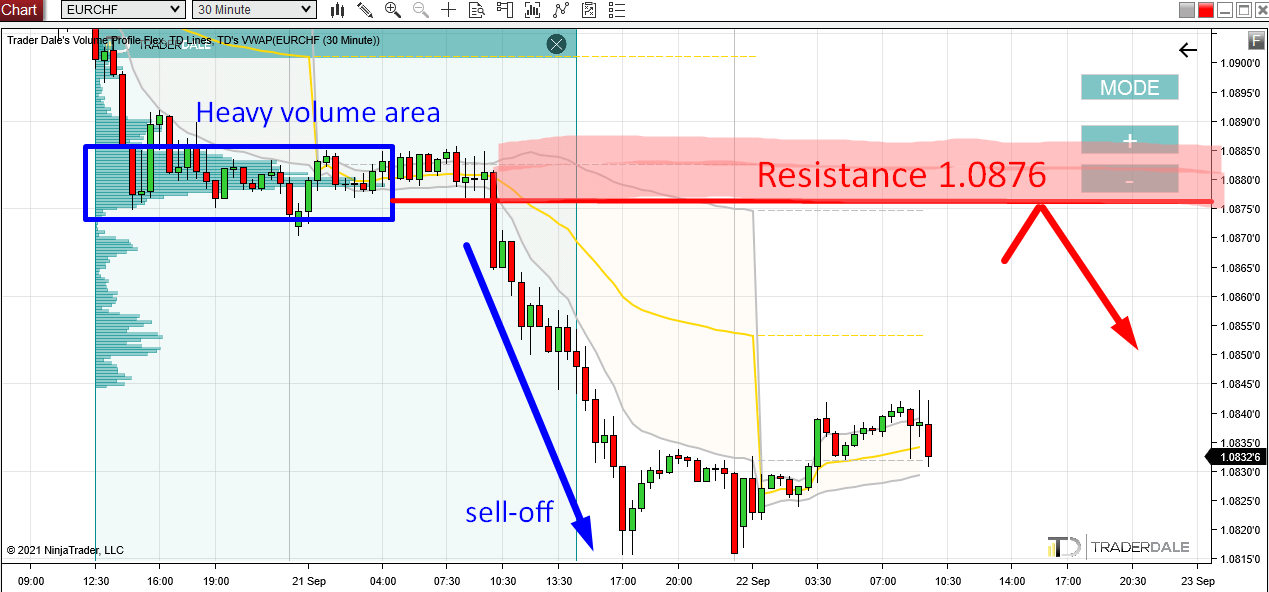

The thing that caught my eye was a tight price channel/rotation from which a strong sell-off started.

What usually happens in such rotation is that BIG institutional traders are building up their huge trading positions.

They do it in a rotation so they are not recognized and their intentions stay hidden.

What those BIG guys do next is they start a trend. This is where their trades start making money.

In this case, it was a downtrend (a sell-off).

This tells us that the BIG guys who were building up their trading positions were strong Sellers.

You can see those big trading positions using my Volume Profile indicator. It nicely reveals the institutional trading activity within the rotation area.

EUR/CHF, 30 Minute chart:

What the Volume Profile Tells Us?

What we have now is this information: There were strong institutional Sellers building up their Shorts in a heavy volume area starting around 1.0876.

This is an useful piece of information we can work with.

When the price makes it back into this heavy volume area, then those strong Sellers will most likely want to defend this zone. It is clearly important for them because they placed a lot of their Short trades there.

Also, potential Buyers will be aware of this heavy volume zone and would not want to risk a possible fight with strong institutional Sellers there (around 1.0876).

So, what they will do when the price reaches the 1.0876 area? They will start quitting their Long trades. To quit a Long trade, they will need to Sell, and a Market Sell Order will help to push the price downwards again.

Both these factors (Sellers defending, and Buyers getting rid of Longs) should work together around the 1.0876 area and make this zone a strong Resistance.

The Volume Profile setup I used here is called the “Volume Accumulation Setup“.

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment