Classic Trading Books – Review

Recently, I’ve got many of you asking me about recommendations on trading books. That’s why I decided to dedicate this article to you. Here are a few great books that left a considerable impact on me as a trader throughout the years. I will also be talking about how I implemented their ideas and principles into my own trading. I hope you’ll enjoy it.

”One Good Trade” by Mike Bellafiore

About the book

Its full name: ”One Good Trade – Inside the Highly Competitive World of Proprietary Trading” refers to the insight into a real-life proprietary firm named ”SMB Capital”.

In this book, you will get an opportunity to hear about the successes and failures of a variety of different traders who took their chances of trading with institutional money. It’s written in the first-person point of view by its co-founder Mike Bellafiore.

I have found it very entertaining to read. The author has a great sense of combining industry professionalism with a healthy dose of humor.

But that’s of course not all. The main reason I’m sharing it with you is the fact that the author shared his principles and techniques that have enabled him to navigate the most challenging of markets at that time (please don’t miss concept it with a trading strategy, he isn’t explaining that).

The main principle is written directly in its name: One Good Trade.

Do you want ME to help YOU with your trading?

Join one of my Volume Profile Educational courses and get my private trading levels, 15 hours of video content, my custom made Volume Profile indicators, and more!

Ideas & fundamentals

I will start this paragraph by reciting one from the book: ”Make a list of the trades that work best for you. Visualize making successful trades. Then make One Good Trade and then One Good Trade and then One Good Trade.”

This idea is very logical and easy to understand for everyone. However, most don’t manage to apply it to their trading. What the author wanted to say with it is that it’s important to ONLY take trades that are GOOD according to your strategy.

Also, it isn’t enough to just place one good trade and that’s all. We must place one good trade, after one good trade, after one good trade, without making any bad trade in between. In short, we have to stick to what works, and only what proved to work.

Keep in mind, that a good trade can also be a trade which hits Stop Loss. It does not need to be a winner! A good trade is a trade which you planned and executed perfectly according to your proven strategy regardless of its outcome.

I talk about this some more in my Volume Profile book.

Here are the SMB Capitals fundamentals as noted in the book:

1. Proper preparation

2. Hard work

3. Patience

4. A detailed plan before every trade

5. Discipline

6. Communication

7. Replaying important trade

2. Hard work

3. Patience

4. A detailed plan before every trade

5. Discipline

6. Communication

7. Replaying important trade

Since we aren’t institutional trades but retail ones, we can ignore the 6th – ”Communication” in this case.

The most important of all is the last one, we must keep making ”one good trade…” no matter what!

Don’t lower your criteria

The thing is that people tend to unintentionally lower their criteria when trading good for some time. That’s the reason big winning streaks are often followed by even bigger losing streaks.

That’s why it’s very important to always be sure we aren’t lowering our criteria. Each and every trade we place must be ”one good trade”. That’s the only way to have consistency in this market.

So, let’s recite it once again: ”Your job is to make One Good Trade and then One Good Trade and then One Good trade.”

”Trading in the Zone” by Mark Douglas

The full name of this book is: ”Trading in the Zone: Master the Market with Confidence, Discipline and a Winning Attitude”. The author, Mike Douglas, is talking about the right state of mind which is needed for consistent trading. He calls it ”trading in the zone”.

I think this could be especially beneficial to those who trade a bit advanced way where psychology plays a bigger role. For example, using Order Flow as confirmation to enter the trade based on Volume Profile.

Douglas takes on the myth of the market which states that it’s all about technical and/or fundamental knowledge. He exposes it as teaching traders to accept the true randomness of market movement and look at it in probabilities.

There isn’t a way to know for sure about the direction in which the market is going to go next, and we must accept it.

I’ve found this book very amusing to read and easily went throughout many pages in one sitting. It’s both because of its theme and the author’s interesting style of writing.

What exactly means to ”trade in a zone”?

The ”zone” refers to a specific mental state which allows one to think about the trade and the trade only. It is a synonym to 100% focus and concentration at trades in front of you, without any distractions aside.

After I’ve read the book, I realized that each time I succeeded in making a winning streak it was because I was really ”in the zone”.

Overall, I think this book has a great potential to leave a huge impact on you as a trader.

This autobiography was first published all the way back in 1923. It follows Jesse Livermore, an American stock trader still considered a day-trading pioneer to this day.

The book is very amusing since it shares the excitements from some of the most unique times of market history. As called ”the world’s greatest trader”, Jesse Livermore was trading huge during the 1906 San Francisco earthquake and the Wall Street Crash of 1929.

After various ups and downs in his life, he ended up committing suicide on November 28th, 1940.

However, in his golden years, he was one of the richest people in the world.

I would definitely recommend reading it, especially if you are a stock trader!

A FREE gift for you

As a thanks for reading until the end of this article, I will give one of you guys a small present – my own physical copy of the book: Reminiscences of a Stock Operator.

All you have to do is leave a comment below this article with the recommendation of your favorite book on trading!

Let there be just one rule:

- Each person is allowed to write just one comment with one book recommendation.

On the 1st of September, I will pick one winner and send it to his address.

The best Edge I found…

As you can see, all of these books are focusing on the trader’s mindset, not technical analysis.

There are tons of books about technical analysis out there, but as I concluded in my recent article about trading consistency, we must stick to only one thing that gives us the Edge.

If we have many proofs our thing already works, why search for something else? The only thing I recommend here is to modify our strategy while maintaining our Edge. This way we will be able to take the most out of the market.

The best Edge I discovered throughout my 12+ years trading career lies in trading with Volume Profile.

I found out that sadly, there was not a single Volume Profile book with practical and immediately actionable info about trading with volumes written!

Yea, there were some “old classics” but they didn’t really teach a practical way of using the Volume Profile.

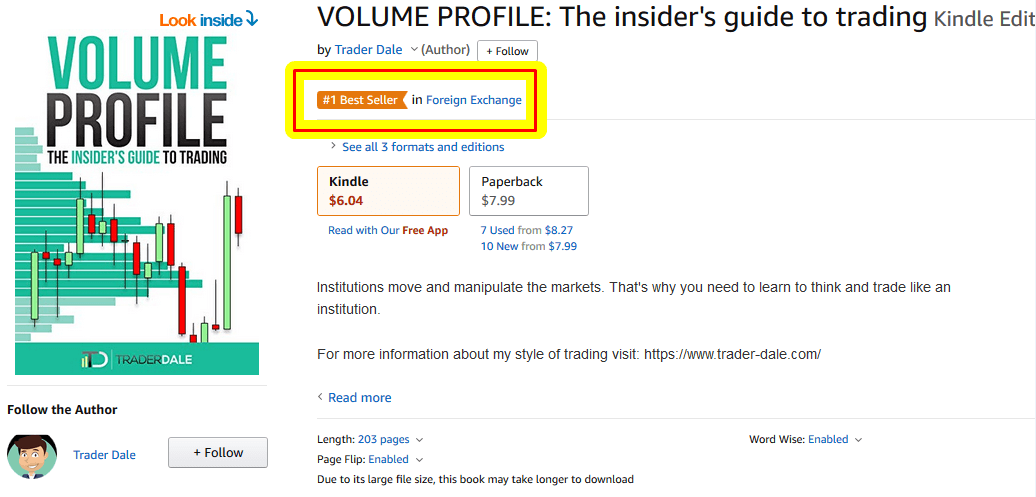

So, in the end I decided to write my own Volume Profile book. Just within a few months it became an Amazon bestselling trading book!

As a thanks for being here with me and being part of our trading community, you can download my complete Volume Profile book for FREE here:

I hope you liked this article guys.

I’m looking forward to reading your own book recommendations in the comments section!

Cheers,

– Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment