My friend, professional trader and a member of my Private Trading Course Ziggy came up with a very effective plan. This plan will show you how to manage your intraday trades and how to spend only a few minutes every day on it.

I need to stress out that devising such a plan wouldn’t be possible without thorough trade statistics like Ziggy has. So I would like to thank him for keeping his records and for giving this helpful info to all of us.

Here is his research and his Set & Forget method:

Set & Forget Trading Strategy With Aggressive Money Management – by Ziggy

I need to say right at the outset that if you can be at the screen to manage trades then by far the better way to trade is to trade as Dale does (here is how: Dale’s trading style), but if you cannot be at the screen and still wish to trade you are left with 2 options, either using an EA to manage your trades or some form of set and forget trading.I hate MT4 with a passion as a trading platform and as a consequence will not use an EA, it is my belief either rightly or wrongly that because of the way an MT4 platform works with the broker that slippage on stop loss orders will be substantial – & my perception is that slippage has become a bigger issue than it was 1 year ago.

Set & forget trading

The reason I am looking to trade on a set & forget basis is that my life circumstances have changed & whereas I was happy to sit at a computer desk all day long & also get up in the middle of the night if alarms rang, I no longer can do this or if I’m honest wish to do it. I do not need to trade but after years of having done so am reluctant to let years of gaining experience & not a little pain in the process just go down the toilet, so it would be nice to make some extra cash while limiting my screen time to around 1 hour per day. So I set about finding a way I could do this with my own preferred instrument, the Dax, and if I’m doing that, I thought I’d see if I could also make a few extra quid from Dales EU levels.Most of my trading has been a form of breakout trading, which has the problem of slippage on entry and the greater the £ value, the greater the slippage – at least that has been my experience. The beauty of Dales trading is I can use limit orders to enter a trade, in principle, this means there shouldn’t ever be slippage no matter what the size of the position at the point of entry. There are circumstances where it can happen, but 99.9% of the time it won’t. This is a great advantage as it means that for trade entries the only thing which needs to be considered is having a bank sufficient to cover margin requirements and of course my own risk limitations.

Trading rules

My data – I have complete records of all Dales published levels for the past 2 years on EU, but this was on the basis of micromanagement, some things that come with micromanaging but not set & forget are as follows.- If a level is tested, the order was removed – if set & forget that order would remain in place until I next looked at the screen.

- If a trade becomes live & a reaction to the level does happen, the stop is moved – if set and forget it will either hit the profit level or the stop level.

Profit Target & Stop-loss

On this basis I assume every trade triggers during the day will either win or lose, with the exceptions of any that are covered by what I have just said above. This means that tested levels that are subsequently hit do become active trades, and this means a greater stop would be a wise precaution – and if I want to apply a staking plan, I also want to have a process that has a high strike rate.Because I trade in the UK, I want to “spread bet” my trades, this way under current legislation there is no tax to pay. This is a big advantage, and as a consequence, I do not use IC markets as my broker – all my trades have a fixed spread of 0.7 pips on EU and zero commission, this is the basis of all my calculations.

*NOTE: Current conditions with IC markets on EUR/USD are usually 0.0 pip spread and around $7 commission per 1 lot. This means basically the same conditions as Ziggy has in the UK.

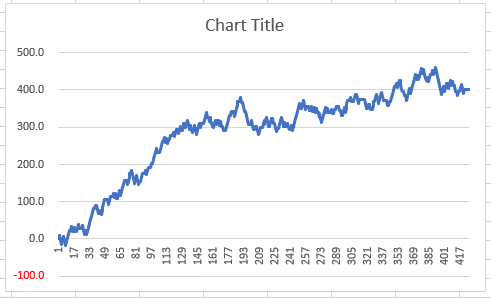

Having factored in all of the above, this is how the pip count would have grown over the 2 year period using a 12 pip stop & 10 pip PT.

This using a 15 pip stop and 10 pip PT.

This using a 20 pip stop and 10 pip PT

The 15/10 looks the better shape but I am looking for around a 70% strike rate & 15/10 gives around 65%, the 20/10 gives a 70% strike rate and the size of the dips regarding the number of full losses, is less.

Staking Plan

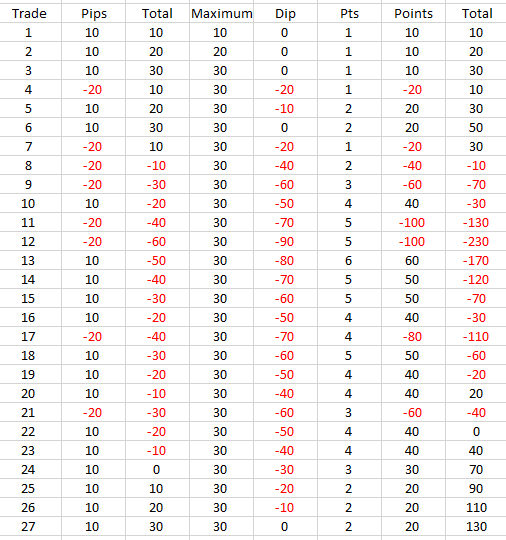

There is an infinite number of ways to put together a staking plan, the most infamous being the martingale – I want something that is within my comfort zone, is simple to operate and will give me a worthwhile return. What is a worthwhile return is dependant on each individuals circumstance, if you have a £1000 bank growing it to £2000-£3000 over 2 years most likely isn’t why we come into forex trading. If on the other hand, you have £50,000 to invest you can put it into the stock market as a passive investment, make an ok return but can also risk seeing your capital fall quite significantly. That same £50,000 could be used in trading, and yes there will be falls in the capital but if the likely return can be 50% p.a. then those falls in capital become an acceptable risk. This is the sort of goal I am looking for and why I am prepared to trade in this manner.My simple staking plan – using simple pip total

Pip total at max – next stake =1 pointPip dip -1 to -20, next stake = 2 points

Pip dip -21 to -40, next stake = 3 points

Pip dip -41 to -60, next stake = 4 points

Pip dip -61 to -80, next stake = 5 points

Pip dip -81 to -100, next stake = 6 points

Pip dip greater than -100, next stake 7 points – maximum stake = 7 points

Below is an example of trading through a horrible period, you can see if just traded at £1 in the “normal” way, over the course if 27 trades the total bank would be +£30 having had a bank dip of £90 at it’s worst. Using the staking plan the total bank would be at +£130 but would have suffered a bank dip of £230. This shows the double edge sword effect of a staking plan.

Using this plan over the past 2 years, it would have produced this graph in terms of points.

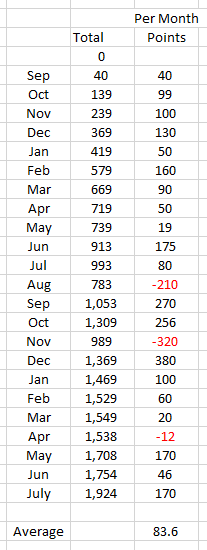

And this is how the monthly totals would have panned out.

What return to expect

So at £10 per point an average of £830 per month, worst month -£3,200, and over the course of the period the worst dip would have been -£4,000 – but I think it’s a fairly safe assumption that it will at some stage be worse than that level of dip.If you compare it with the total gain of +£20.000, then this is for me an acceptable way to trade. It recovers losses reasonably quickly, but if anyone else were to consider doing so first, I make no guarantees and second you really must understand you will suffer big bank dips, you must embrace that fact. If you can accept that fact, and cannot be at the screen to manage your trades, then this is a way to trade on a set & forget basis that has over the past 2 years produced a good outcome.

One final point – this is EU only – I have no idea how other pairs would be, except I do know they won’t be as good as EU. If you were to add another pair within the same trading bank, it would end up in disaster.

Dale’s final notes

The main idea behind all this is that you stake little bit more every time you lose. This way you recover faster from your losses. A system like this can be pretty dangerous, so you need to be very careful and trade only the best performing instrument – in this case, the EUR/USD. You need a high strike rate (even with negative RRR), and you need to be prepared that there will be dips in your equity. You also need a good statistics (like Ziggy has) that will tell you what dips you can expect.IMPORTANT!

In our conversation, Ziggy asked me to emphasize that this method could be pretty risky because of the staking. When you are on a losing run, there will be big equity dips which you need to go through. It may be too painful for some to handle. It is an aggressive method, don’t forget that! Overall we both agree that it is better to manage your trades but if this isn’t possible for you – or if you don’t want to sit in front of the screen all day, then this is a good alternative.Happy trading,

-Dale

P.S. Check out my new book: VOLUME PROFILE: The insider’s guide to trading

P.S. I am using my custom made Flexible Volume Profile for all my analysis. You can get it here: TD’s Flexible Volume Profile

P.P.S. Want my intraday trading analysis every day as well as swing trade analysis for 15 forex pairs every month? Then check out my Advanced Volume Profile Training Course and Members Forum for more information – Click Here to Start Learning Now

Comments

Post a Comment