Hello guys,

today I would like to have a closer look at the USD/JPY.

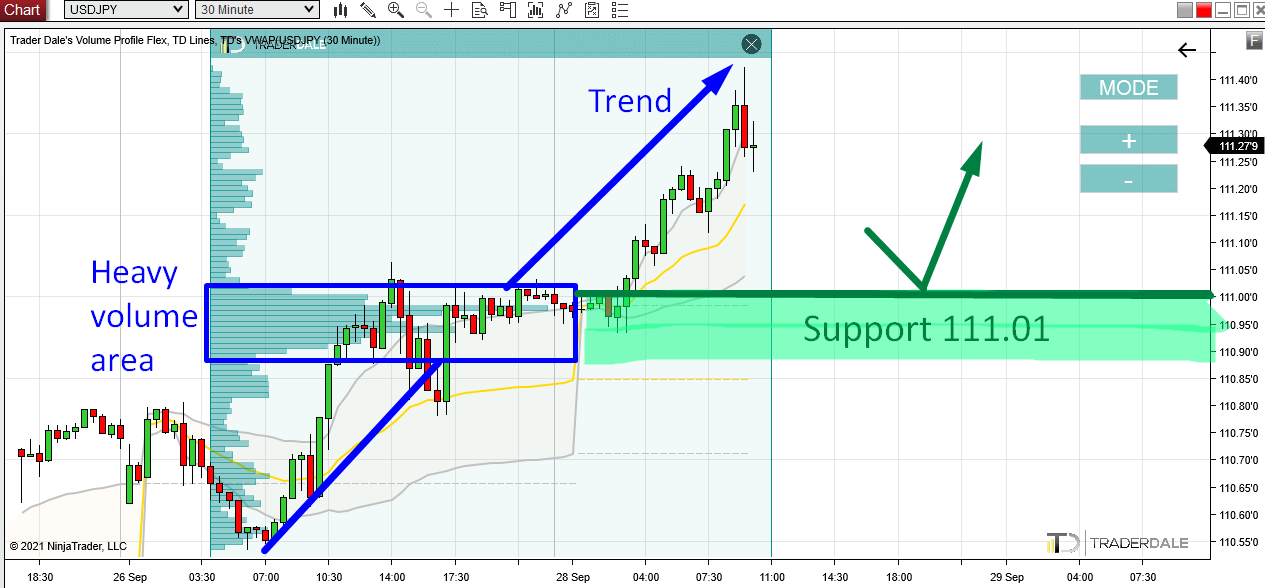

For the last couple of days this pair has been in a strong uptrend.

I am always interested in trading trending pairs and I always want to jump in the trend and participate in it.

However, I don’t just jump into the trend without any thought. I always wait for a pullback. A pullback to heavy volume area.

Why heavy volume area? Because those represent strong Support and Resistance zones.

In this case, strong institutional Buyers are pushing the USD/JPY upwards aggressively.

Volume Profile Analysis

What my Volume Profile indicator is telling me is that those Buyers were adding to their Longs around 111.01.

As you can see in the picture below, this is the area where the Volume Profile is wide = heavy volumes were traded there.

Because the uptrend continued from here, we can assume, that Buyers were adding to their Longs there (in the heavy volume area starting around 111.01)

USD/JPY; 30 Minute chart:

The heavy volume zone starting at 111.01 is an important area now. The reason is that strong institutional Buyers were adding to their Long positions there – they are clearly interested in this zone. They would not want to let the price go past it. Not without a fight.

This is the reason I think, that when there is a pullback to 111.01 those strong Buyers will want to defend this zone and this should make it a strong day trading Support.

The setup I used here is called the “Volume Profile: Trend Setup“.

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment