Bitcoin shot through its historical highs and continues sharply upwards.

If you were only eyeing BTC and now you feel like you missed a big opportunity then you may be tempted to jump in a Long position now, as the prices are skyrocketing.

My advice would be not to do this. One of my general rules is: Don’t buy at highs and don’t sell at lows.

Buying the Bitcoin now would be buying for the highest prices ever.

What I would prefer is to wait for a pullback = for the price to drop a bit. Drop where? To a place where big institutions were placing many of their Long positions.

Such an area is around 19.000.

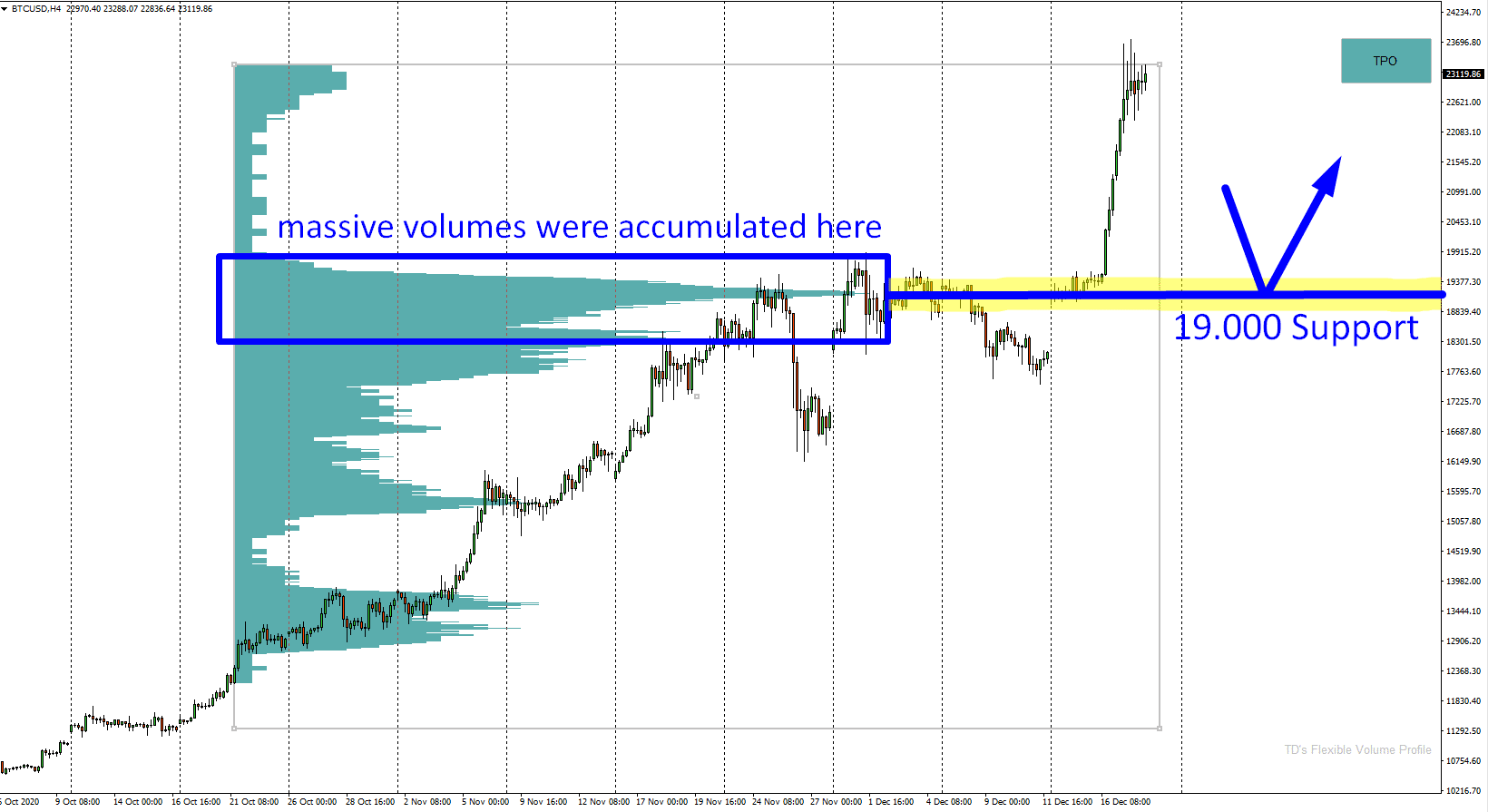

I used my Volume Profile indicator to look into the current uptrend. There is one place in this area that really stands out. In this area (19.000), huge volumes were accumulated. After this volume accumulation, the price shot upwards.

This tells me that in this heavy volume area strong Buyers were building up their Long positions.

When there is a pullback into this area again, those Buyers should defend this zone. They should become active and push the price upwards again.

And that’s why this 19.000 zone should work as a strong Support.

BTC/USD; 4 Hour chart:

Do you want ME to help YOU with your trading?

Will Bitcoin Crash After New Year?

In the end of this brief analysis I would like to warn you about Bitcoin. The way I look at it is that Bitcoin has become pretty popular.

Big funds and institutions who will be giving end of year reports to their shareholders and investors will want to have a big share of Bitcoin in their portfolio. Why? Because these investors will 100% ask them “Did you buy BTC for my investment portfolio?” They will ask because they see BTC skyrocketing the whole year, right?

How would a portfolio manager look like if he said, that he hadn’t bought BTC for them? He would look stupid since it seems everybody is making money on BTC. Not having it would look like a missed opportunity.

So, there is the end of the year and the fund managers start to buy BTC because they don’t want to look stupid when they file their end of the year reports without a share of BTC in it.

This could be in my opinion one of the reasons the BTC is doing so good in the last couple of days.

What if there is a crazy selloff in January? BTW. I wouldn’t really be surprised by that.

Those portfolio managers would say – “Well, everybody was in BTC, it’s not our fault it fell. Everybody had it, we are not stupid. Nobody could have known it would fall. You yourself wanted to have BTC in your portfolio!“

Funny, right? But that’s how it often goes.

Why I am writing this is because I want you to consider all the possibilities and do a bit of critical thinking before investing into skyrocketing and popular investment products like the BTC.

In my opinion it is way better to learn how to trade properly, with an actual edge (like for example Volume Profile), rather than following the crowd and buying popular products without a second thought.

I hope you guys liked today’s article. Let me know your thoughts on Bitcoin (or the other cryptocurrencies) in the comments below! I am really interested in what you think.

Happy trading!

-Dale

P.S. I have just released a new book called ORDER FLOW: Trading Setups. If you purchase one of my trading courses (now -50% Discounted – Christmas Sale), you will get the book for free!

Volume Profile Course – 50% discount

Order Flow Course – 50% discount

*The book is now EXCLUSIVE to members of my trading courses (not available in any store)

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment