Dear traders,

I decided to dedicate this article to all of you who are still struggling with reaching consistency in profitability. There are many of you asking me things like: ”which is the best place for stop loss for this trade”, ”what’s an ideal take profit target for that trade”, ”what do you think of this example”, etc…

There is one critical thing you need to understand, stay with me.

Tom’s story

Let’s start with an example: Tom started trading forex 2 years ago. He listened to numerous podcasts, watched tons of free YouTube trading videos, even bought a few different courses from people who seemed to know what they were doing. He jumped from indicator to an indicator, strategy to strategy, majors to crosses, scalping to swing trading… But he never actually reached any consistency in profits. Now, after 2 long years, Tom is wondering why? What is he doing wrong? Is there something really important he has been missing all the time?

The answer is YES, there has been something he has been missing!

Stick to your trading strategy

What Tom is missing is nothing more than sticking to one thing, repeating it over and over again and keeping a trading journal with the result of every single trade he did sticking to that same set of rules he decided for. Sounds simple, right?

This extremely simple thing is by far the biggest reason traders don’t reach desired consistency in profits. I will explain it further…

This extremely simple thing is by far the biggest reason traders don’t reach desired consistency in profits. I will explain it further…

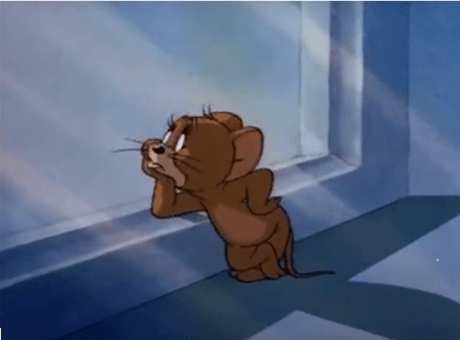

Not understanding the core principle, Tom is thinking about which strategy to use next

Let’s have two examples and compare them

- Tom is jumping from strategy to strategy and always changing something in his trades. He never does even 10 trades in a row the same way with the same set of rules. He is wondering how he can improve and has nothing that could help him except looking for new ways and new strategies.

- Jerry, his old competitor, sticks to one set of rules he saw that actually works (for example my simple swing trading strategy which has published results since June 2017 and which can be accessed by any of my members who receive my daily & monthly trading levels). He is writing in the diary the outcome of each trade he did for the last 2 years. You see where I’m going with this one? Think of it a bit before you move to the next paragraph.

What is the thing Jerry can do to improve that Tom can’t?

Jerry can go through his whole trading history and easily learn from his mistakes. He can see the similar characteristics of losing trades and make a backtest about ”how would it all end up if I just did this one thing a bit different through my whole trading until today but still sticking to the base strategy”.

And that is what I call The Core Principle of Trading.

Over-optimized strategy

There is one important thing regarding this. The thing is that you need to be careful about too much optimization. Over-optimized strategies give you perfect results in the past but they fail in the future.

For this reason, always try to have your strategy simple and robust.

Also, whenever you alter your strategy make sure to test it on different time period or different trading instrument than the one you did the optimization on. This out-of-sample test will tell you whether the little tweak you did was a good idea or no.

You can for example trade it for a month on a real, micro account and see how that goes. This is one of the simplest ways to test it.

Understanding the core principle, Jerry is thinking of a little tweak in a current strategy which will give him a few percent better monthly return

Do you want ME to help YOU with your trading?

Join one of my Volume Profile Educational courses and get my private trading levels, 15 hours of video content, my custom made Volume Profile indicators, and more!

Conclusion

Tom, as usually, got outsmarted. Can Tom do the same thing as Jerry? Unfortunately, without enough real trading data he can’t!

So, how will he improve if he doesn’t know exactly when and why he did what he did?Unless he starts going through his past trades, his chances of improvement are very low!

Learning from your own mistakes is one of the most valuable lessons. He lost 2 whole years of his trading journey without tracking what he did wrong and what he did right.

Learn from his mistakes and also from your own ones. Get out of all the noise and trading communities with tons of people exchanging different trading ideas at different markets. Even if you get your profits here and then, in the end it leads nowhere.

You need to feel confident about YOUR system, YOUR set of rules you set based on YOUR results that you see in front of you.

Take your time, make a lot of trades, and then go through your trade history and see if there is anything you could have done differently in your system to avoid some of the losing trades or get more of the winning ones. The little tweak could be for example in using a different Risk Reward Ratio, trading with different time frames, changing the way of quitting your trades, etc…

All of the knowledge you need is here on this website. If you would like a comprehensive training with professional indicators, then I definitely recommend getting the Elite Pack from HERE.

Have a nice day,

-Dale

Recommended Forex Broker

Having a solid broker with low spreads and commissions is ESSENTIAL for PROFITABLE TRADING! Check out my recommended brokers

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment