Hello guys,

today I will have a closer look at the NZD/JPY.

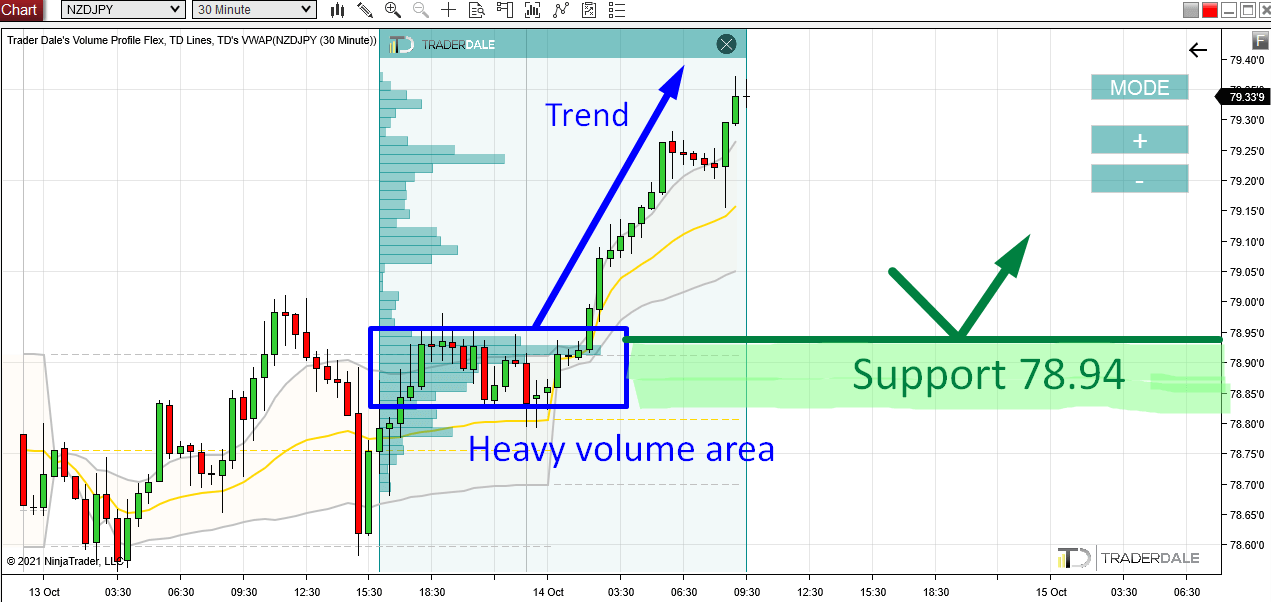

Since the start of today’s Asian session, there has been a strong uptrend. It seems that strong Buyers are pushing (manipulating) the price to go higher.

What happened before this trend? There was a rotation. The price was moving in a tight price channel.

Volume Profile Analysis

I used my Flexible Volume Profile indicator to look into this whole area to see how volumes were distributed there.

In the picture below, you can see that there were heavy volumes traded (accumulated) within the rotation area. From there the uptrend started.

Those heavy volumes tell us that it were likely BIG institutional traders who were building up their Longs slowly & unnoticed in that rotation. From there they manipulated the price upwards to make those Longs profitable.

NZD/JPY, 30 Minute chart:

This heavy volume zone starting around 78.94 is now important for them because they placed a lot of their trades there.

When the price makes a pullback there again (at some point in the future), then it is likely that those strong Buyers will become active again = they will start buying again. They will try to manipulate the price to go upwards again.

This is what will make the area starting around 78.94 a strong Support zone.

This is one of my favorite Volume Profile setups and you can learn all about it in my Volume Profile Trading Course.

Do you want ME to help YOU with your trading?

Price Action Analysis

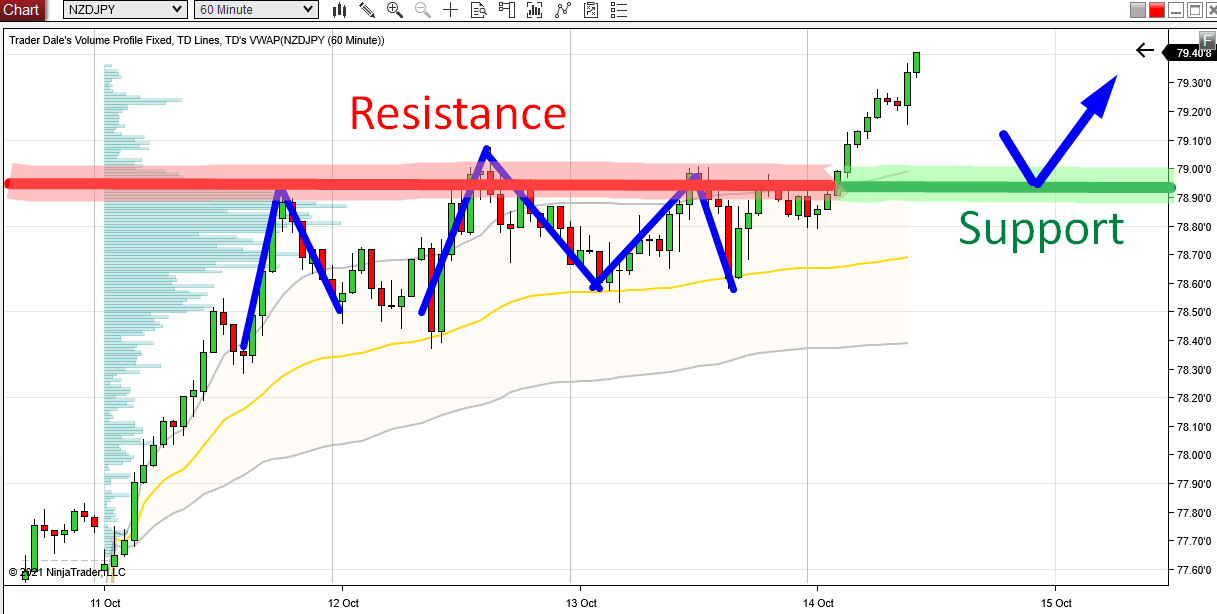

Additionally to this, there is also one more trading setup pointing to the 78.94 area.

It is a Price Action setup called which says that a breached Resistance becomes a Support.

If you look at the picture below, then you can see that the price already bounced off this 78.94 area three times earlier this week.

This means that it worked as a strong Resistance.

This Resistance got breached today and this turned it into a Support.

As you can see both the setups – Volume Profile and Price Action point to the same Support zone around 78.94.

This is a nice confluence and it adds strength to the Support. I like to look for such confluences whenever possible. The more, the better!

NZD/JPY, 60 Minute chart:

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment