Hello guys,

I hope you didn’t miss yesterday’s video with trading ideas for this week! If you did, then check it out here:

Weekly Trading Ideas (30th August 2021)

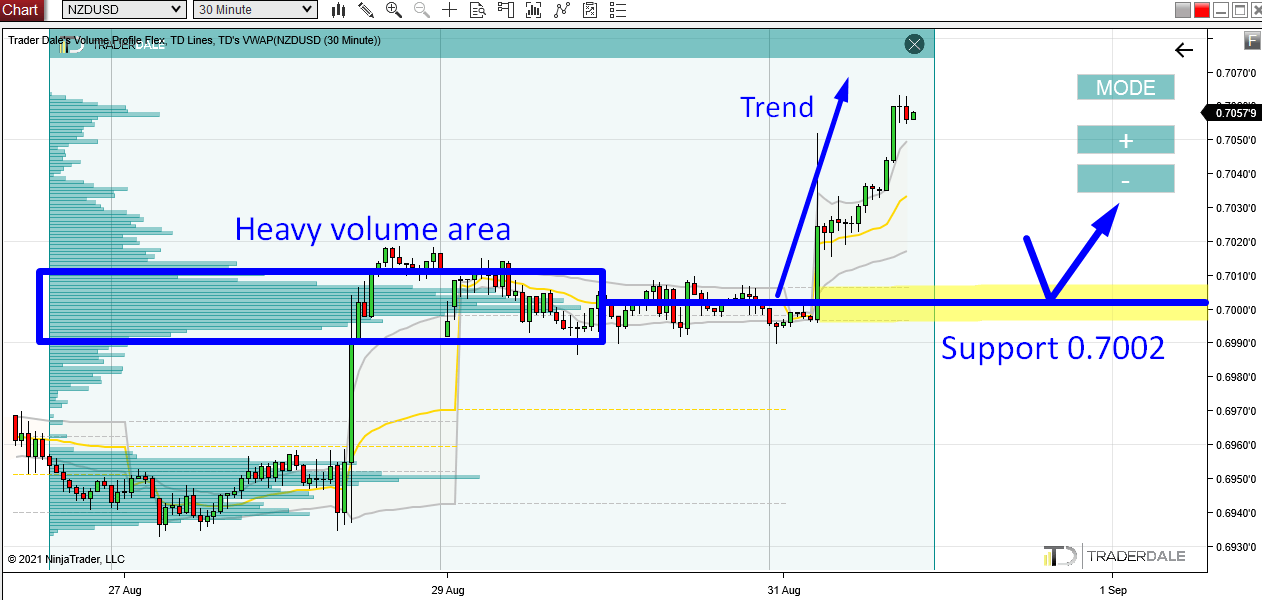

Today, I would like to have a closer look at NZD/USD.

The reason I am interested in this pair is that there has been a strong uptrend action starting in the Asian session. Such action tells us, that there are strong and aggressive Buyers pushing the price upwards.

Volume Profile Analysis

Those Buyers most likely entered most of their Long positions the heavy volume area that got formed before the trend.

It is usually like this because the BIG trading institutions need to accumulate their massive trading positions in a rotation. That’s why there is always a rotation and then a trend (a pattern very often seen all across the markets).

If you use my Volume Profile tool, then you will see the heavy volume area very clearly.

NZD/USD; 30 Minute chart:

The information we now have is this: There were strong Buyers in a zone around 0.7002. those Buyers then pushed the price upwards aggressively.

If there is a pullback into this zone again (around 0.7002), then those strong Buyers should try and defend it.

This zone is important for them. The reason is that they placed a lot of their trades there – that’s why it’s important.

This is why it should work as a strong day-trading Support.

This Volume Profile setup is called the “Volume Accumulation Setup“.

Weekly Point Of Control (POC)

Another nice addition to this Support is that the zone around 0.7002 is also a Point Of Control (POC) of the current week. This means that the heaviest volumes this week (so far) were traded there.

The Weekly POC adds strength to our Support.

NZD/USD; 60 Minute chart, Weekly Volume Profile:

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment