Hello guys,

today, I will do an intraday trading analysis of the EUR/GBP.

There was a pretty interesting development yesterday. There was a rotation, and then a strong buying activity (uptrend).

This tells me that:

- There were strong Buyers building up their Long positions in the rotation area

- Then those Buyers pushed the price aggressively upwards (that’s the uptrend).

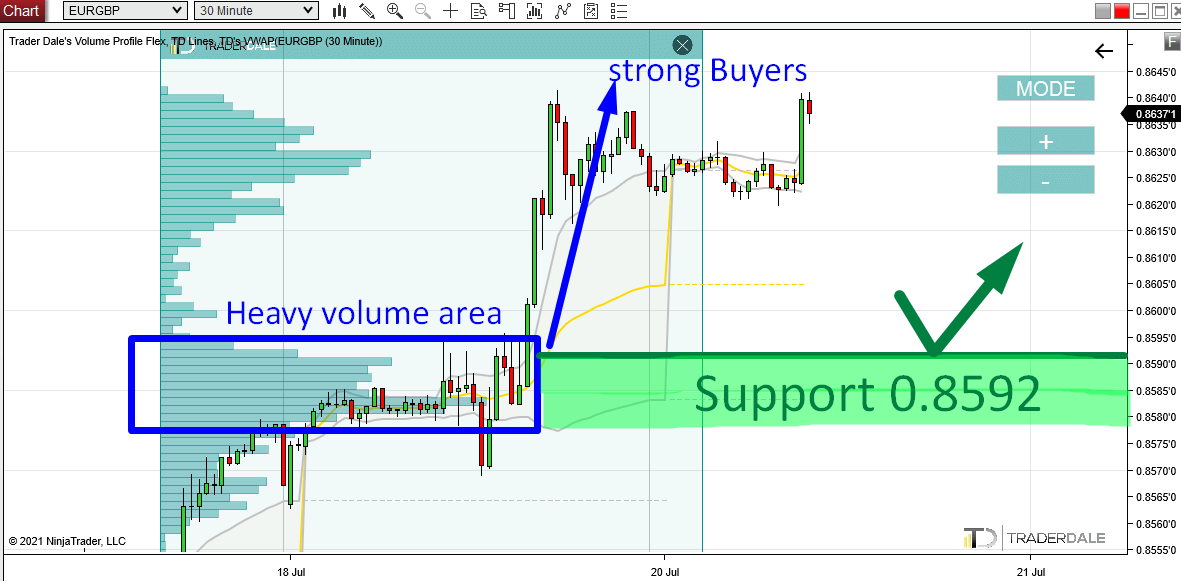

I used my Flexible Volume Profile to look into this area to see how the volumes were distributed there.

As you can see from the picture below, there were heavy volumes accumulated in the rotation area. Those are the strong Buyers who were building up their Longs there.

EUR/GBP; 30 Minute chart:

When the price makes it back into this heavy volume area again, then it should work as a strong Support.

The reason being is that the BIG institutions who were building up their Longs there will want to defend this zone. This zone is important for them because they placed a lot of their positions there.

This is why this zone (starting at 0.8592) should work as a strong Support.

This Volume Profile setup I used here is called the “Volume Accumulation Setup“.

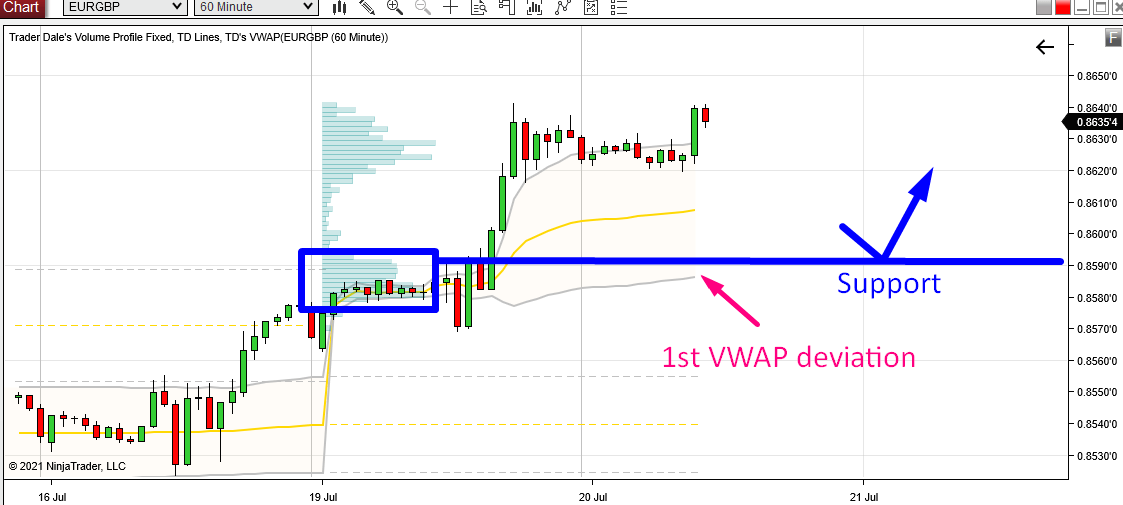

VWAP Setup

What I also like about the zone around 0.8592 is that the 1st VWAP Deviation is very close. It is still developing (moving) but right now it all looks really good!

If it stays somewhere near this area, then there will be another nice confluence – a VWAP setup that I call the “VWAP Rotation Setup“.

This setup basically says that when the price moves in the area between the grey lines (1st Deviations), then it should bounce off them – they work as Supports/Resistances.

EUR/GBP; 60 Minute chart; Weekly VWAP:

If you want to learn more about my VWAP setups then you can watch this recording: WEBINAR: VWAP TRADING STRATEGIES

My Previous Prediction on EUR/GBP

BTW. the last week there was a very similar scenario as today – a Support on EUR/GBP based on the “Volume Accumulation Setup”

This is the original prediction & analysis I made the last week:

EUR/GBP: Volume Profile and Price Action Analysis

This is the PREDICTION → RESULT:

I hope you guys liked today’s analysis! Let me know what you think in the comments below.

Happy trading!

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment