Hello guys,

today, I will have a closer look at the EUR/GBP.

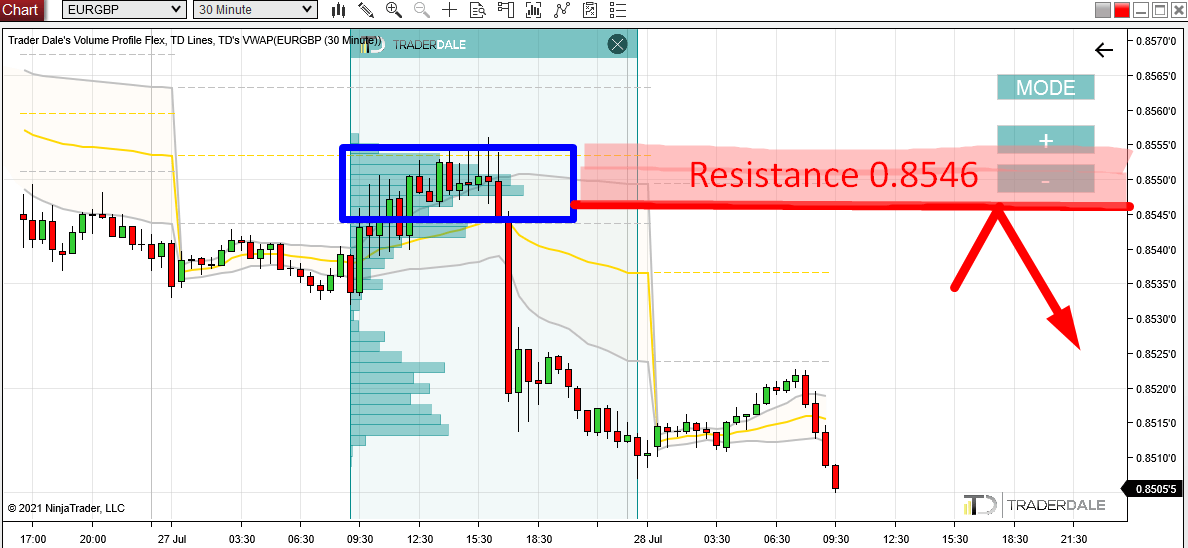

What caught my eye at first was a strong selling activity yesterday (that huge red candle you can see in the picture below).

Such a strong and rapid sell-off is a sign of aggressive sellers.

Those sellers were most likely building up their Short positions in the rotation that took place before the sell-off.

You can see those volumes nicely with my Flexible Volume Profile indicator.

EUR/GBP; 30 Minute chart:

Those heavy volumes that were accumulated before the sell-off are quite important and I think those were the BIG institutional traders getting ready before manipulating the price downwards.

When the price makes a pullback into this area again (starting around 0.8546) then those BIG guys will want to defend this zone and push the price downwards again.

This is what should make this zone a strong Resistance.

A Two-Week POC

Another nice addition to this Resistance is that it is a very significant volume-based level even from the bigger perspective.

This Resistance also represents a place where the heaviest volumes throughout the last two weeks got traded! This means it is a two-week POC (Point Of Control).

You can see that on the picture below, where I merged two weekly Volume Profiles into one two-week Volume Profile.

This is another thing that adds strength to our Resistance around 0.8546.

EUR/GBP; 60 Minute chart; Weekly Volume Profiles:

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Hola, podrías poner tus libros de Kindle en español por favor? Gracias

ReplyDelete