Hello guys,

today’s day trading analysis will be on the AUD/JPY.

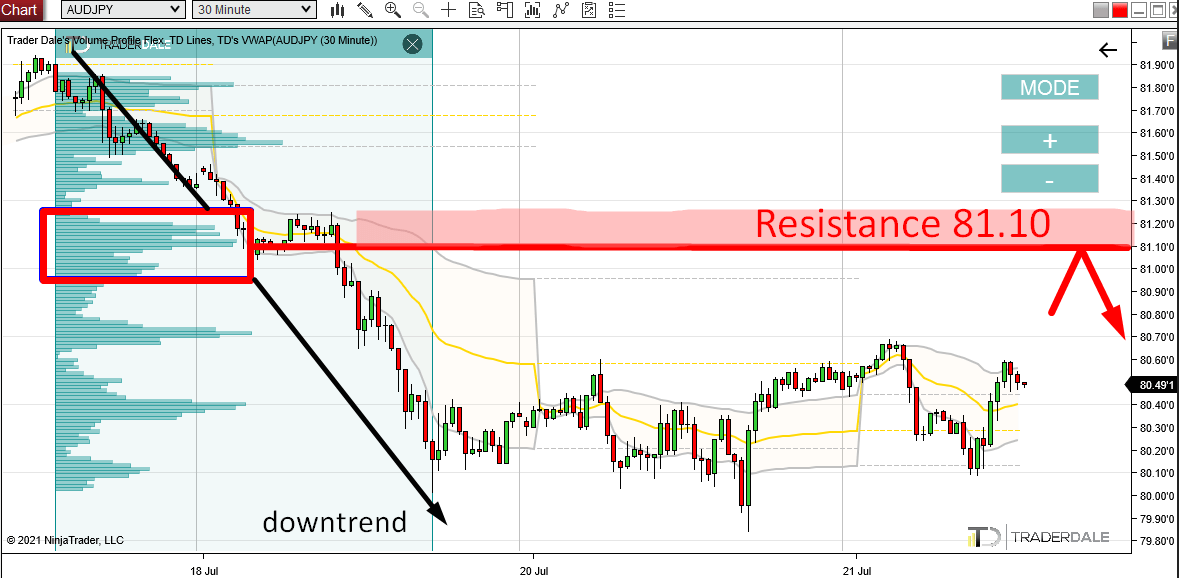

There was a pretty strong downtrend a couple of days ago on the AUD/JPY. This is something I am always interested about because a trend usually means that the big guys (big trading institutions) are moving and manipulating the market.

I am always interested the most in how the volumes were distributed within the trend, because volumes = the BIG guys.

What I do is I use my Flexible Volume Profile to look into the trend and I look for significant Volume Clusters.

Look for Volume Clusters

Volume Clusters are the little bumps on the profile. They show where heavy volumes were traded – and thus the activity of the BIG guys.

Right now, there is a significant Volume Cluster around 81.10.

I think that the BIG institutions who were driving this downtrend were adding to their Short positions there.

This zone is now important for them, because they placed their trades there.

This is an important information because when the price makes it back into this zone again, those BIG guys will want to defend this zone.

Defend = manipulate the price downwards from there again. And that’s what makes this a strong Resistance.

This setup is called the “Volume Profile – TREND SETUP“

AUD/JPY; 30 Minute chart:

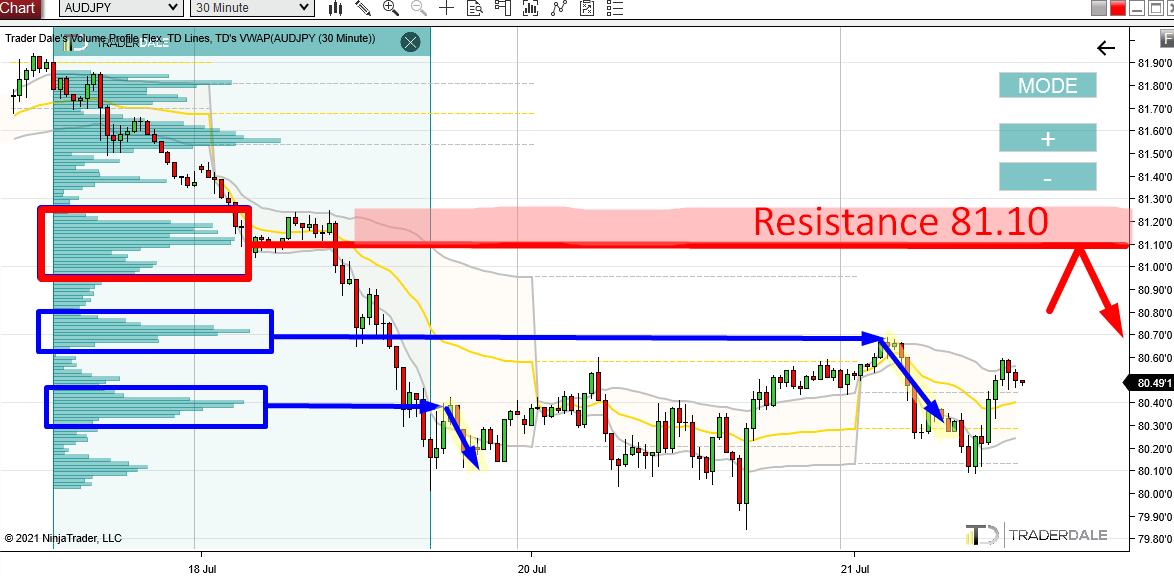

Already “Tested” Volume Clusters

As you have probably noticed, the Volume Cluster around 81.10 is not the only one there.

There are also two significant Volume Clusters below it.

The difference between the 81.10 and the two Volume Clusters below is that the lower Volume Clusters got already “tested”.

The price has already made a pullback to them and there were already reactions.

For this reason, I consider those Volume Clusters “spent”.

The closest significant Volume Cluster that hasn’t been tested yet is the one around 81.10

AUD/JPY; 30 Minute chart:

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment