Hello guys,

in today’s day trading analysis I will focus on the current uptrend on the CHF/JPY.

When there is an uptrend, then I don’t fancy chasing the market, and entering longs when the price is at the highs of the trend.

What I prefer is wait for pullbacks. I wait until the price retraces down a bit, and then I enter my Longs.

Look For Volume Clusters

Retraces to where? To places with significant volumes. I call those Volume Clusters.

Whenever there is an uptrend I use my Flexible Volume Profile to see how the volumes were distributed inside that uptrend.

Exactly like in this case.

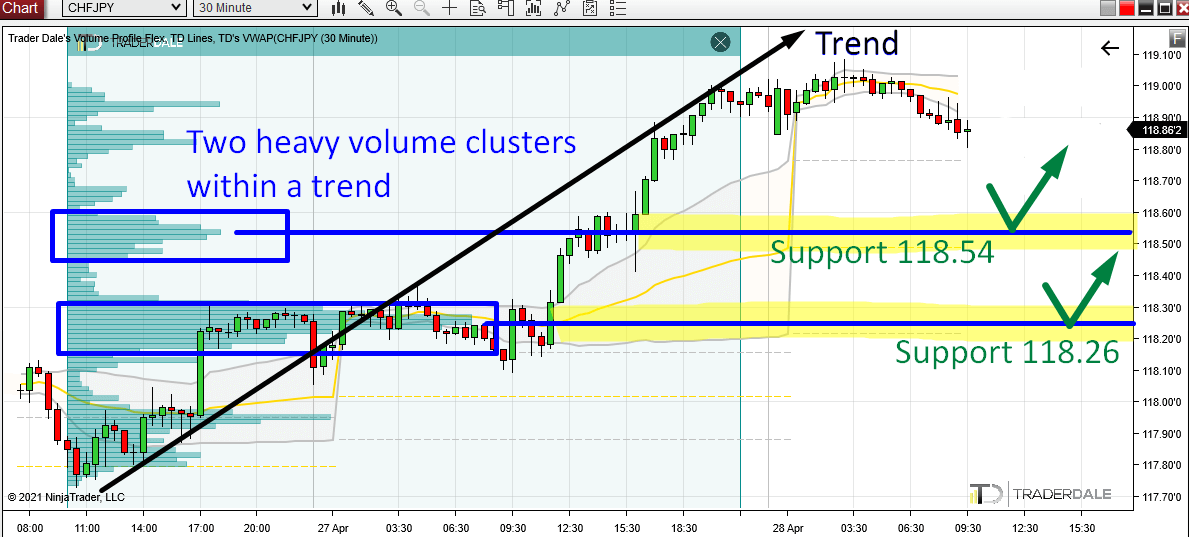

CHF/JPY; 30 Minute chart:

When you use the Volume Profile like this, then it will nicely reveal those Volume Clusters – areas where institutional buying activity took place.

On the CHF/JPY there are two areas that stand out and that I like. The first one is a Volume Cluster around 118.54, and the second one is a Volume Cluster around 118.26.

In both those places heavy volumes got traded. Most likely, it was big trading institutions entering more Longs and getting ready for another push upwards.

Those are places I think the Buyers will defend and that will work as Supports.

This is one of my favorite setups and you can learn more about it here: Volume Profile: Trend Setup

Do you want ME to help YOU with your trading?

Price Action Setup as an Additional Confluence

But let’s not stop just there! There is more to those two areas I showed you. A very nice confluence with a Price Action setup!

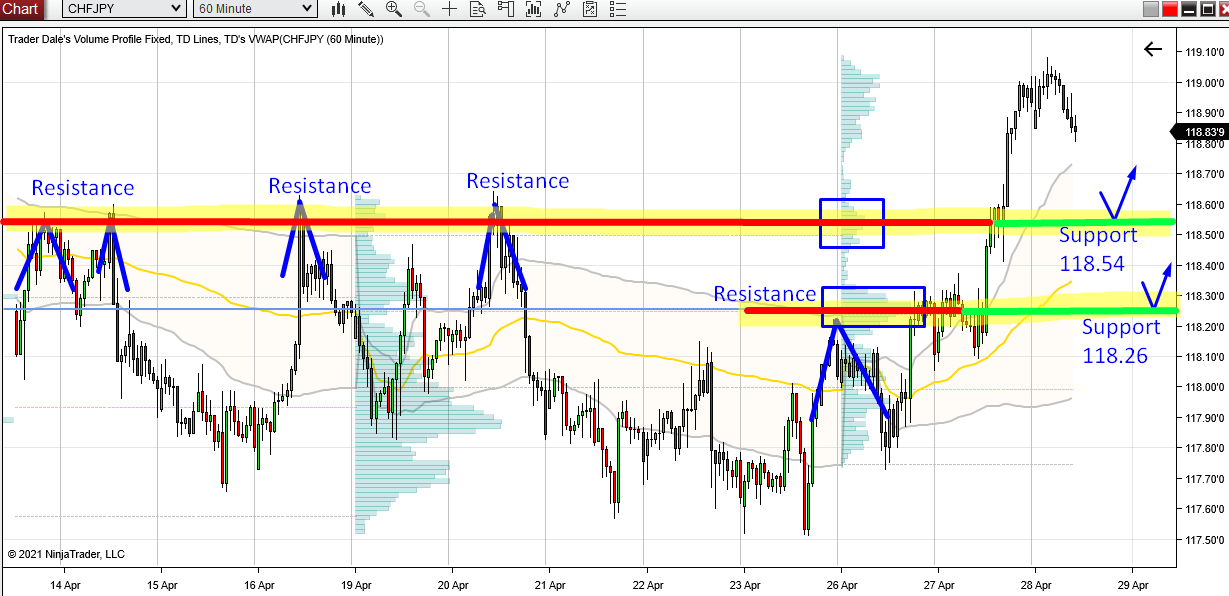

Both those levels – 118.54 and 118.26 worked as Resistances in the past.

The price reacted four times to the zone around 118.54, and once to 118.26. This tells us that those areas already worked as Resistances in the past. You can see that in the picture below.

When a Resistance gets breached, it then becomes a Support. This is an old and simple Price Action setup I like to use and combine with my Volume Profile setups. Just like I did it here.

CHF/JPY; 60 Minute chart:

If you would like to learn more about this setup, then you can do so here:

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment