Hello guys,

today’s analysis will be about a new day trading Support that has formed recently on CAD/JPY.

This one struck me at first sight, to be honest. It’s easily visible and hard to miss.

Price Action Analysis

The first two things to notice here is a very long rotation on CAD/JPY. It lasted almost three full days. Then, from this rotation, a strong uptrend started.

This is the thing that struck me at first sight. Why? Because this is the first step to my Volume Accumulation Setup – a Rotation followed by a trend. Ideally, a long rotation followed by a strong trend. Like in here.

The next step is to look at volumes.

Usually, when there is a rotation heavy volumes get traded there. You can see that when you use my Volume Profile tool.

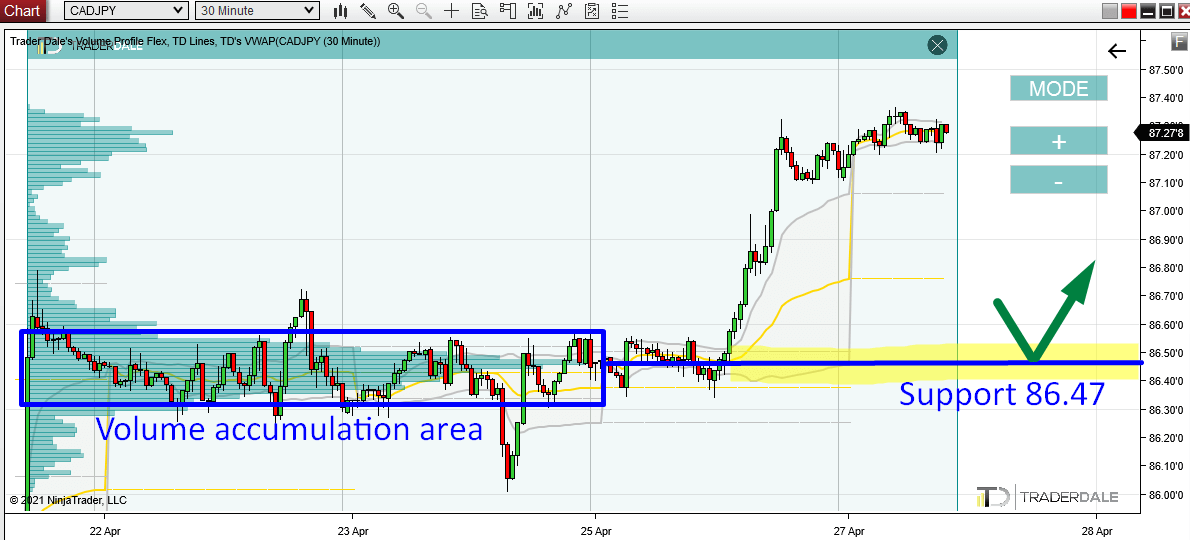

CAD/JPY; 30 Minute chart:

As you can see in the picture above, there were massive volumes traded in this rotation. This is where strong institutional Buyers were accumulating their Long positions. Slowly, and unnoticed. Then they pushed the price upwards aggressively (using Market Orders).

The heaviest volumes got accumulated at 86.47. This is where the Volume Profile is the thickest.

When the price comes back into this area at some point in the future, then I expect the strong Buyers who placed their Longs there to push the price upwards again. They will want to defend this zone because it is important for them. They placed a lot of their Long orders there before.

Do you want ME to help YOU with your trading?

Two-Week Point Of Control (POC)

A really nice addition is that our Support at 86.47 is also a Point Of Control (POC) of the last two weeks! This means that the heaviest volumes in the last two weeks got traded there.

This is sort of a “confirmation on the bigger picture“. Bigger picture why? Because we used Weekly Volume Profile, and also bit higher time frame (60 Minute).

CAD/JPY; 60 Minute chart:

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment