Hello guys,

in today’s daily analysis I will talk about a newly formed Support on USD/JPY.

Yesterday, there was a long rotation on USD/JPY. Nothing special, really. But what made this rotation interesting was the strong buying/trend activity that followed in today’s Asian session.

Why? When there is a rotation followed by an uptrend, then it indicates that strong Buyers were building up their Long positions in that rotation. They were doing so slowly and unnoticed. Then they pushed the price aggressively upwards.

Volume Profile Analysis

When I see a rotation followed by a trend, I use my Flexible Volume Profile and I check out the volume distribution in that rotation and trend area.

What I want to see is heavy volumes in the rotation. Exactly like in the picture below!

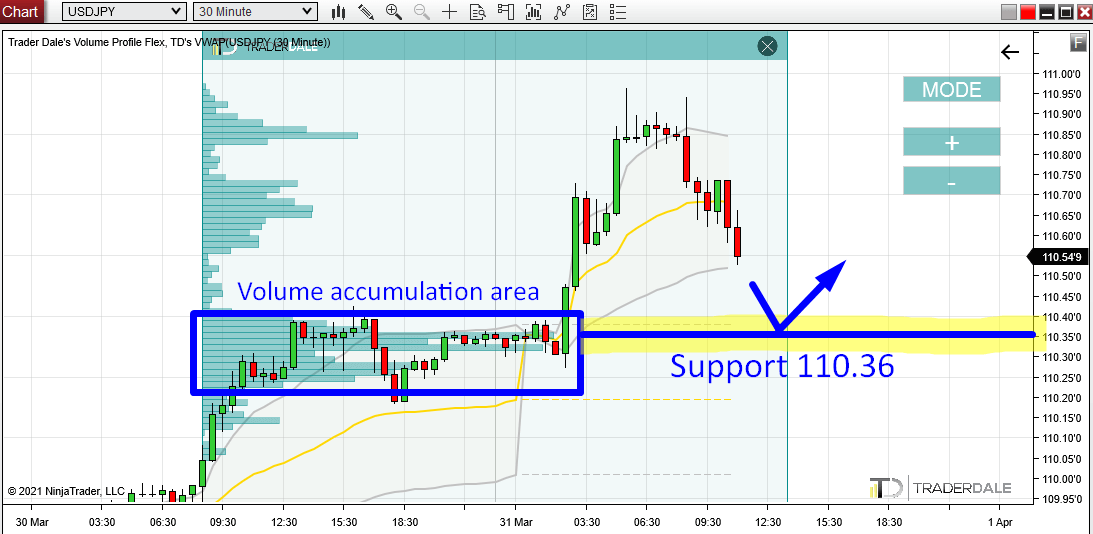

USD/JPY; 30 Minute chart:

Those heavy volumes show the big institutional market participants getting into their Longs.

When the price makes it back into this zone (in this case around 110.36) then those institutional traders should defend this zone. Why? Because they placed a lot of their Long positions there. This zone is important for them!

They will want to defend this zone by pushing the price upwards from there again. That’s what makes this zone a strong Support.

This trading setup is one of my favorite Volume Profile setups. I call it the “Volume Accumulation Setup“.

Do you want ME to help YOU with your trading?

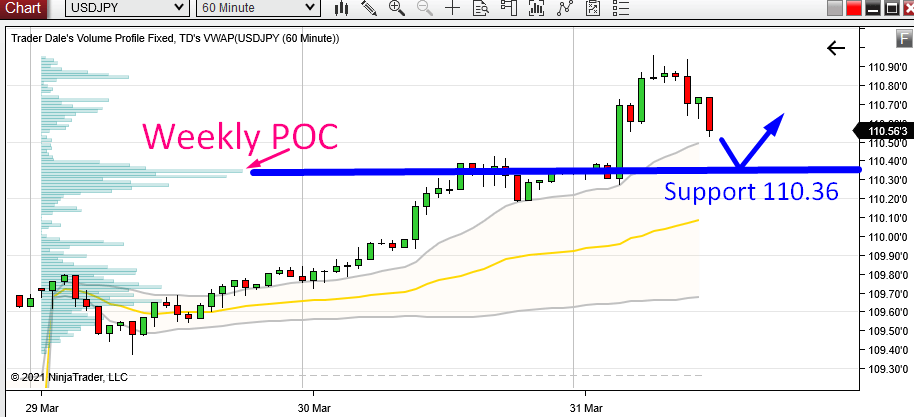

Weekly Point Of Control

A nice addition to this is that our zone around 110.36 is also the Weekly Point Of Control (POC). This means that the heavies volumes from this week were traded there.

A strong trend activity commencing from a Weekly POC is always a very important thing to notice as the Weekly POC represents the most important price level from the whole week.

The chart below shows USD/JPY; 60 Minute chart with Weekly Volume Profile:

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment