Hello guys,

today’s day trading analysis will be on EUR/NZD.

The first important thing to notice is the strong uptrend which started yesterday.

When there is an uptrend like this, I always like to use my Flexible Volume Profile indicator to look for significant Volume Clusters.

Those Volume Clusters are sort of “bumps” that show on the Volume Profile in the trend.

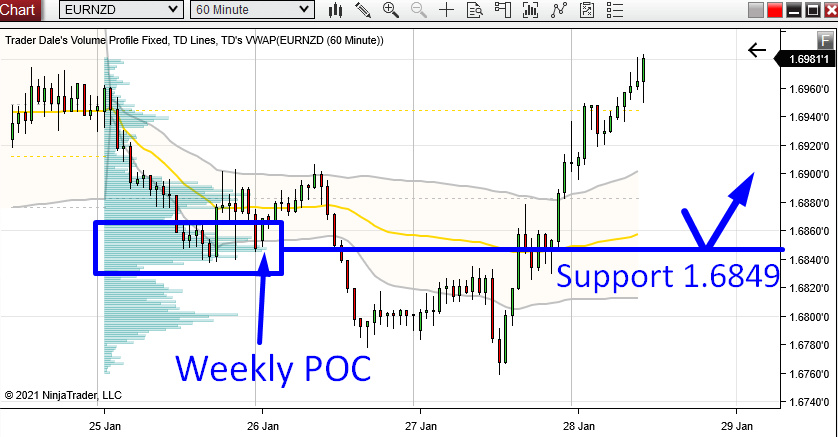

The most significant Volume Cluster in the current trend area has now occurred around 1.6849.

So, what’s the story?

As the buyers were pushing the price upwards into that trend, they slowed down around the 1.6849 and they started to add to their Long positions.

This is what created the Volume Cluster.

Afterwards, they started to push the price aggressively upwards again – trend continues.

EUR/NZD; 30 Minute chart:

Now we know, that the area around 1.6849 is a very important zone for the big institutional traders, who were entering their Long trades there.

When the price makes it back to this area again, we can expect that those buyers will want to defend this zone.

We can expect that they will start buying again, and that this will drive the price upwards from there again.

This is why I think the 1.6849 could work as a strong day trading Support.

Weekly POC

A nice addition is that our Support lies exactly at the Weekly Point Of Control (POC).

The Weekly POC represents a place, where the most volumes got traded through the whole week.

I always like to look for Weekly POCs in my trading, because they often represent strong trading levels.

EUR/NZD; 60 Minute time frame:

*My Volume Profile automatically prints the Weekly Volume Profiles, where you can easily spot the Weekly POCs.

I hope you guys liked today’s analysis. There are more in the MARKET ANALYSIS section. Check them out!

Happy trading!

-Dale

Do you want ME to help YOU with your trading?

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment