This article is the last part of a four-part Beginners Guide to Order Flow. Here are links to all parts:

In this last part of the Beginners Guide to Order Flow series I will show you how to get the trading platform running, how to get high quality data and what trading instruments are best to trade with Order Flow.

PLATFORM & DATA

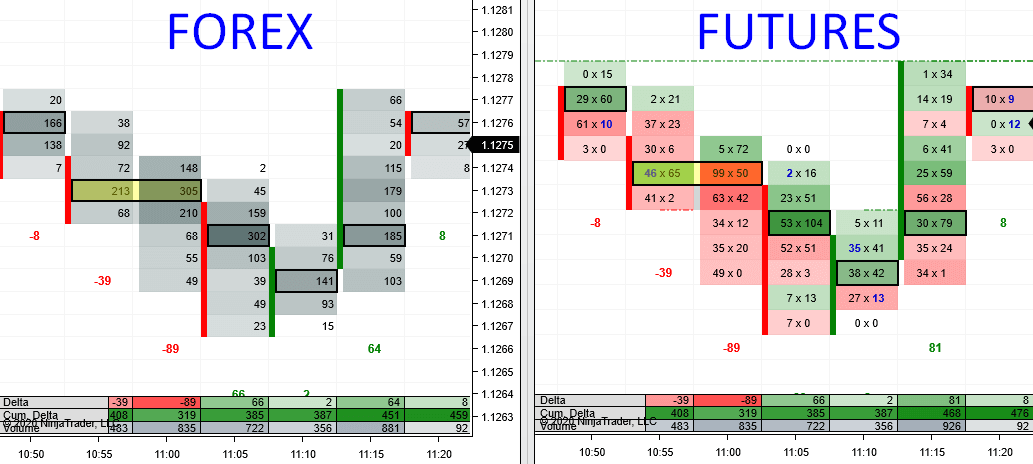

Order Flow relies on good data. The best you can do is use Futures data

in your analysis. The reason is that Futures is centralized (opposed to

Forex which is decentralized). Centralized data means that everybody on

the planet gets the same data.

There is also a paid NT8 version but you don’t need that!

I have been using the free platform in trial mode for years. The way I do it is that I do my analysis using advanced indicators (Volume Profile, VWAP, Order Flow) in NinjaTrader 8 platform, and then I place the trades in my brokers platform (not in NinjaTrader 8). I advise you do it the same way. This way you will be using a fantastic and free charting platform (NT8), and trade with your current broker (or with our recommended broker).

You can download the NinjaTrader 8 free platform here: NinjaTrader 8 trading platform download

NinjaTrader 8 (NT8) platform

My Order Flow software was developed for NinjaTrader 8 trading/analysis platform. This platform is completely free. You can use the trial/free version indefinitely. It will work 100% and it includes all the functions you will need.There is also a paid NT8 version but you don’t need that!

I have been using the free platform in trial mode for years. The way I do it is that I do my analysis using advanced indicators (Volume Profile, VWAP, Order Flow) in NinjaTrader 8 platform, and then I place the trades in my brokers platform (not in NinjaTrader 8). I advise you do it the same way. This way you will be using a fantastic and free charting platform (NT8), and trade with your current broker (or with our recommended broker).

You can download the NinjaTrader 8 free platform here: NinjaTrader 8 trading platform download

How to get good NinjaTrader 8 data?

There are three ways how you can get good quality data into NT8:- Purchase it: There are several data-feed packages you can purchase. For me, the best way has always been to email NinjaTrader support, tell them what instruments I wanted and then they gave me a quote for the data-feed. Their support is fast to respond and also really helpful. Their email is here: platformsupport@ninjatrader.com

- Use different emails to get free unlimited data: When you first apply for the NT8 platform, you will get free Forex or Futures data for 14-30 days. Then the data-feed expires and you will need to pay for it. What you can do is simply create a new email and apply for the NT8 trial again. This does not take too much time (a few minutes every month or so) and you will save some money. You can apply for the free data again and again here: Free NinjaTrader 8 data. I made a video on how to do this (it is an older video on NT7 platform, but it works the same with NT8):

3. Fund a $400 account with NT broker.

You don’t need to use this account for trading. Just fund it with $400

and you will get free data-feed. I think this is the easiest and

cheapest solution. Here is a link to do it: Open NinjaTrader 8 Account here

*There is a condition that you need to place at least one trade per month, so you may just open and close the smallest possible trade every month to meet this condition.

*There is a condition that you need to place at least one trade per month, so you may just open and close the smallest possible trade every month to meet this condition.

What to trade with Order Flow?

Order Flow is best used for day trading. I use it mostly for currency futures. The way I do it is that I do my analysis in NinjaTrader 8 with currency futures, and then I execute the trades with my Forex broker on Forex.

This way, every level I have on futures needs to be transferred to Forex. It is pretty easy. I show how to do it in my Video Course which is included in the Elite Pack and in the Order Flow Pack.

You can use Order Flow to day trade almost any trading instrument. The most popular markets are:

This way, every level I have on futures needs to be transferred to Forex. It is pretty easy. I show how to do it in my Video Course which is included in the Elite Pack and in the Order Flow Pack.

You can use Order Flow to day trade almost any trading instrument. The most popular markets are:

- Currency futures

- Indices (S&P 500, Nasdaq, Dow Jones, DAX,…

- Oil, Metals (Gold,…)

- Stocks

Trading Forex with Order Flow is also possible

(at least with my software), but some functions of the Order Flow won’t work. The reason for this is that Forex data-feed won’t give you Bid x

Ask data, but only Volume data (sum of Bid + Ask). That’s why I prefer to do my analysis using currency futures.

Where to get Order Flow?

You can get my custom made Order Flow here:

Happy trading!

-Dale

TD Order Flow Software & Training – Click Here

The Order Flow Package includes Lifetime Access To:- Order Flow software

- Order Flow Video Course (12 hours long)

- Volume Profile Pack

Happy trading!

-Dale

This article was the last part of a four-part Beginners Guide to Order Flow. Here are links to all parts:

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Hey, thanks for the information. your posts are informative and useful. I am regularly following your posts.

ReplyDeleteArtemis Global Life Sciences Ltd