(TIP: you can turn on subtitles and also let them auto-translate into your language)

Do you know what distinguishes good traders from bad traders? It is the ability to get back on track after a really bad losing period. In this article, I would like to show you 8 simple tips to recovering from a drawdown like a trading professional! Those tips will help you survive and recover from a bad period. Next time you are having a tough time you won’t just blame the strategy, markets, broker, or yourself. You will know EXACTLY what to do and you will follow these tips to get into profitability again.

Tip 1: Go through your journal notes

I know I said it many times and I may sound like a broken record, but having a solid trading journal with notes is really important. It’s important because when something goes wrong, you can look into your notes and you will usually be able to identify what you were doing wrong.A few days ago I received an email from a member of my trading course. He wanted to improve his trading and he sent me his trading journal where he marked all his trades along with brief comments. Within just a few minutes I was able to see where the problem was. Btw. he was trading around the news – so I recommended that he start using the FX Squawk service and be more careful with avoiding the news. Apart from the news, everything seemed more or less fine.

I also need to say that the member himself was able to pinpoint his problem using his notes. He was just asking me for my opinion and for confirmation.

That’s what I call a job well done. You have a proper journal and then when a problem occurs, you go through your notes and you work on your weak spots. That’s the way to go.

Needless to say that without a journal, traders in this situation are left clueless, not knowing what happened and what to do.

Tip 2: Go through screenshots of your trades

I think it is really useful to take screenshots of your trades and then to go through them from time to time. Making a screenshot takes literally no more than a minute. If you want to write some short commentary it takes max 3 minutes. Many people don’t do this, and yet, screenshots are so helpful! Especially when you’re in a drawdown, and you need to see what is wrong. Screenshots are really helpful because you look at them and you immediately see the whole picture. It doesn’t take much time or effort to go through let’s say 30 screenshots. Still, a 30 minute period in which you go through screenshots of your trades can really be an eye-opener.If your strategy took a beating, I suggest you go through your screenshots and focus on two things:

1. Focus on things that you did right and that worked. In other words – notice how you were trading and what trades you took when all went fine. Write down the things that you did right – this is really important – to focus on the positive things, not just the negatives. In the future try to do those things that you did right purposefully again and again.For example: Imagine you held your position until it hit your full Profit Target even though you were tempted to close it sooner. That’s great! Write it down and next time do it too.

2. Focus on your bad trades and try to find mistakes. Sometimes there will be trades that were just fine and still ended up as losers – don’t worry about those. What you should look for is trades which ended up as losers because of some mistake you made. Write down those mistakes and avoid doing them in the future.

For example: Are you a gambler and you hold your trades during macro news releases? Then go through your trades and see how much that costs you! Write it down and never trade the news again.

Tip 3: Trade only your best performing instrument

When things turn south you really need to focus on what works best. This way you will be able to regain confidence and also recover from your losses. To be able to tell what your best performing instrument is, you need to keep good statistics (surprise!). For me, the best one is the EUR/USD. I think it works so nicely because it is the most liquid forex pair.My friend and a member of my trading course Ziggy wrote a really helpful article recently. In his article, he presented a method that focuses solely on trading the EUR/USD. It is very interesting and I recommend you read it here: Set & Forget EUR/USD Strategy.

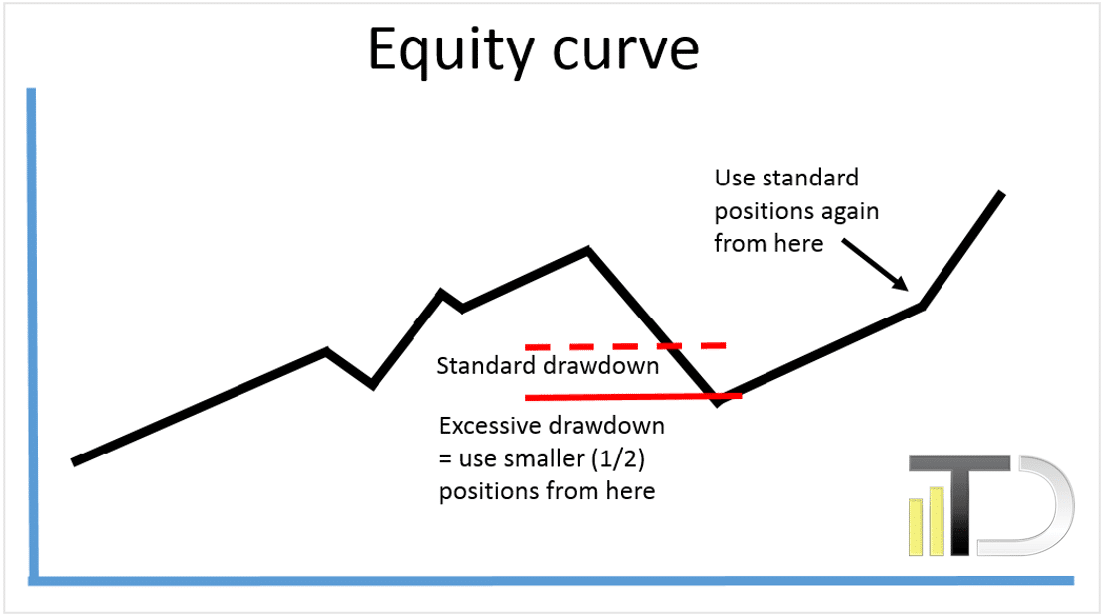

Tip 4: Lower your positions

Has it ever happened to you that you were in a drawdown so big that you were afraid to place more trades? I bet it has. It happened to many traders – myself included. In trading, it is essential that you feel comfortable even when taking losses. Being afraid to enter a trade is certainly not very comfortable. In a case like that, you need to trade smaller position sizes so you feel comfortable and not afraid to open another trade. This way, you will regain your confidence and you will slowly start digging out of the drawdown. You can start using normal positions when you feel confident and comfortable again.Below is a screenshot from my new Volume Profile Book that shows you what digging out of a drawdown using smaller positions might look like:

Tip 5: Don’t stop trading

When a trader takes a beating and he is afraid to enter new trades, then it feels quite natural that he wants to have some rest. It sounds logical, but this is what usually happens:1. The market conditions change and the market plays in favor of his strategy. The trader misses a lot of winning trades. That’s Murphy’s law and it works perfectly in trading.

2. After his rest, the trader feels okay and he takes his first trade. Guess what? A loss and he is back where he was before the pause. He is afraid again to take another trade!

Does this sound familiar? If you really feel you need a rest after you took a beating, then have it, by all means. But don’t jump into trading with full positions right after that. Lower your volumes and get back to full positions only when you really feel confident and back on track again. This way you won’t feel discouraged immediately if things don’t go the way you expected.

Tip 6: Don’t look at the scoreboard

The most frustrated and un-focused traders are the ones who look at their equity and trade results too often. What should really matter most is the perfect execution of the next trade. There is a little trick I invented. The trick is to set your profit/loss column in your trading software to show only the pip count and not nominal win/loss (USD or any other currency you use). This way you won’t get distracted or overwhelmed by how much money you are up or down., you will only see the number of pips.This way, you will be much calmer and it will be significantly easier for you to follow your trading plan. After some time it will start to feel almost as if you were trading a demo! And that’s what you want. You want to feel calm, relaxed and clear headed. Looking constantly at your scoreboard to see how much USD you are currently up or down doesn’t really help.

You can use this method all the time but where it shines the most is when you struggle. When you struggle you start to fear to take the next trade and you fear to lose more money. Looking at the pip count instead of the nominal value takes a big chunk of stress off your shoulders and it helps to think clearly.

Tip 7: Don’t jump from strategy to strategy

I found out that majority of problems the traders have isn’t in a bad strategy. It is their impatience and their inability to follow the strategy and its rules. Don’t be naive – trading isn’t easy. It isn’t like you find a Holy Grail strategy and it starts making you money from day one! In fact, you need to learn the strategy, get a feel for it, learn the rules so they feel natural to you and you need to learn to execute the strategy flawlessly. Only then it will all start to work for you. Not before. Obviously, all this takes time. So don’t be impatient. You will learn it and it will all come to you, but you need to give it some time.If you jump from strategy to strategy you will never have the time to learn anything properly. You won’t be making any consistent profits and trading will become frustrating for you.

What you should do instead, is focus only on one strategy/approach. This strategy needs to make sense to you and you need to feel comfortable trading it.

Tip 8: Switch to a higher timeframe

If you are new to trading and you jumped right to intraday trading, then let me give you an advice. Switch to higher timeframes and start with swing trading first. Intraday trading is simply harder and it may not even be fitting for you. I know it may look tempting to sit in front of your computer 2-3 hours a day, do 20 trades and make a small fortune every day. Unfortunately, it just doesn’t work like that. Most likely you would just over-trade and start losing money quickly.I was also like that in the past – I wanted to do intraday trading. Unfortunately, I wasn’t really able to make any money with it. I started making money only when I started using the Volume Profile and when I started swing trading. Yes, I started making my first consistent profits with swings! Only after I mastered that did I work my way into intraday trading. Now I trade both – intraday and swing.

So, if you struggle, you don’t necessarily need to change your strategy or methodology. Instead, you probably just need to slow down a bit and switch to higher timeframes.

If you are trading using my Volume Profile strategies, then it is relatively simple as those strategies are versatile enough to work on higher timeframes (like monthly, weekly, daily charts) as well as on the lower timeframes (like hourly to 5-minute charts). You literally just need to change the timeframe and adjust your Profit Target and Stop-loss values.

That’s it!

So that’s about it guys. I know taking a beating and being in drawdown sucks, but it is part of trading. Only the best traders know how to deal with a drawdown properly and more importantly, how to dig out of one. Now you know it too!Happy trading

-Dale

P.S. – If you would like my Daily and Swing Levels so that you can start ‘Earning While You Learn,’ then check out our Advanced Volume Profile Training Course and Members Forum for more information – Click Here to Start Learning Now

P.P.S. I have just released a new book: VOLUME PROFILE: The insider’s guide to trading. I put a ton of work into it and I am sure it will prove extremely helpful to you. Go and get your copy HERE. I guarantee you that this will be the best $4.99 you ever spent.

Comments

Post a Comment