Hello guys,

in my yesterday’s post, I was talking about the “Volume Accumulation” setup and about a strong Support on NZD/USD. If you missed it, then you can read it here:

NZD/USD: Volume Profile and Price Action Analysis

Today, I would like to talk about a very similar scenario, but on a different forex pair – on NZD/JPY.

Volume Profile Setup

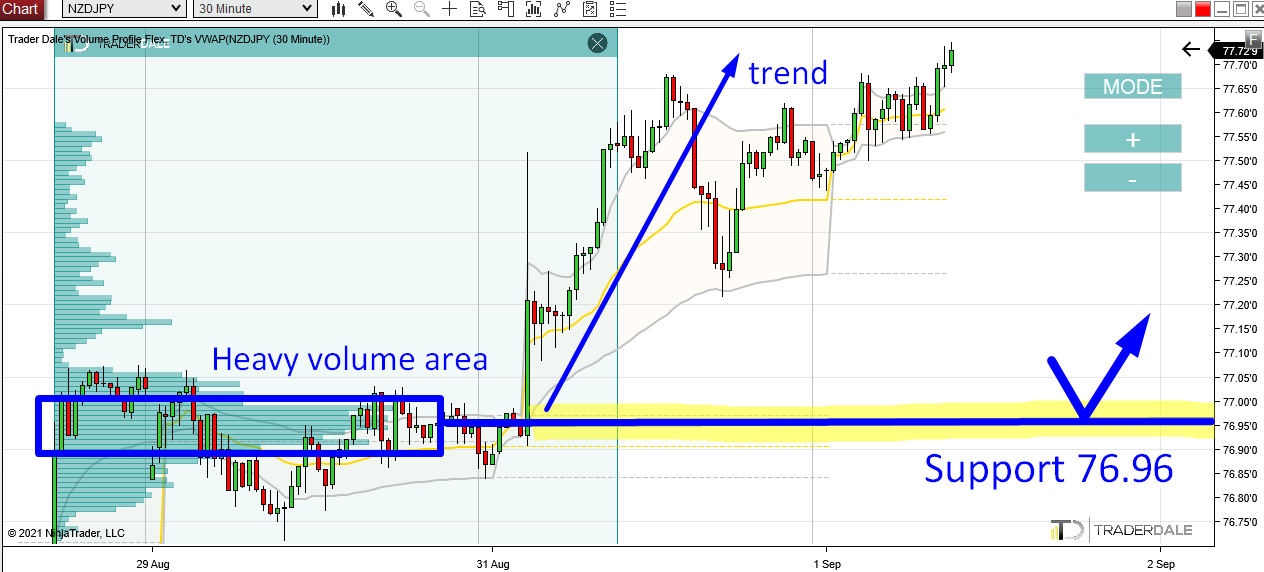

If you look at the chart below, then you can see that there was a rotation area in which heavy volumes were accumulated.

You can see the volumes by using my Volume Profile indicator.

From there, the price went aggressively upwards into a trend.

What this tells us is that strong institutional traders were building up their Long positions slowly and unnoticed in the rotation area. Then they pushed (manipulated) the price aggressively with Market orders to go upwards.

NZD/JPY; 30 Minute chart:

When the price makes it back into the heavy volume area (around 76.96) then it is likely that those strong Buyers will want to defend this zone. It is important for them as they placed a lot of their Long orders there.

They will defend it by adding to their Longs and buying aggressively again with the intention to push the price upwards again.

This is what will make this zone a strong Support.

The Volume Profile setup I used here is called the “Volume Accumulation” setup.

VWAP Setup

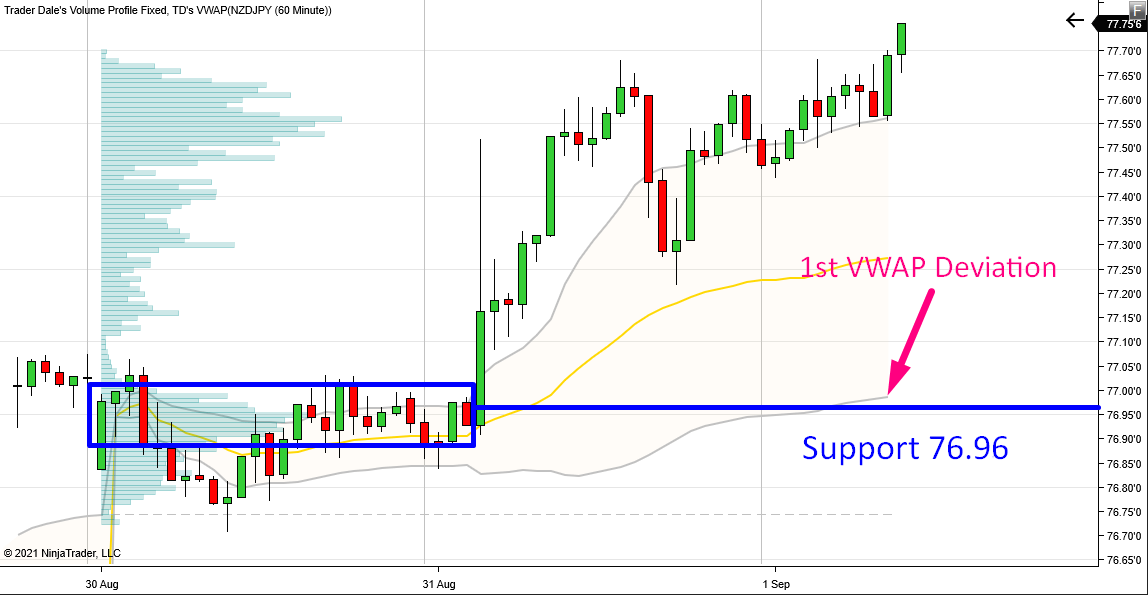

Additionally to the Volume Profile setup, there is also a VWAP setup which is currently pointing to the same Support.

The setup is called the “VWAP Rotation Setup“. The point of this setup is that the price tends to react to 1st VWAP deviations (the grey lines).

Currently, the lower 1st deviation is very close to our Support (around 76.96). It is still moving, but it it stays in this area, then our volume-based Support will be also confirmed by VWAP setup, which of course, would be very nice. The more confirmations and setup confluences, the better!

NZD/JPY; 60 Minute chart with Weekly VWAP and Weekly Volume Profile:

If you would like to learn more about VWAP, then you can watch a recording of a VWAP webinar here:

WEBINAR: VWAP Trading Strategies

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- Other Apps

- Get link

- Other Apps

Comments

Post a Comment