Hello guys,

today, I would like to have a closer look at the AUD/JPY.

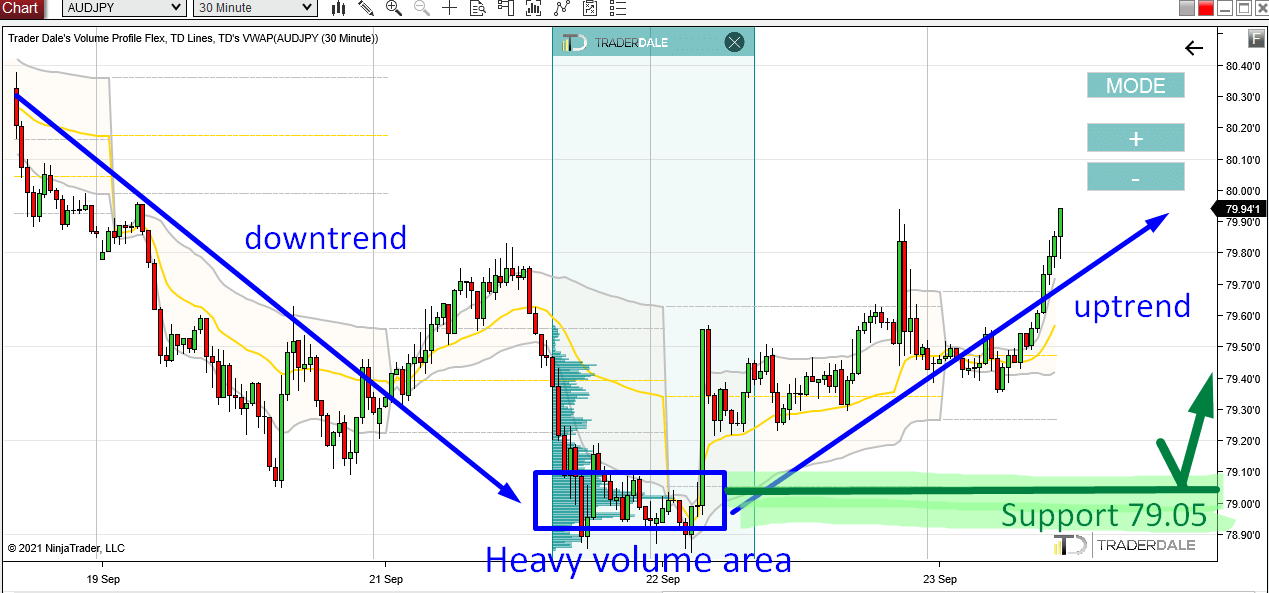

It seems, there has been a change in the trend. From a downtrend to an uptrend.

What happened at the lowest breaking point where the trend changed? There was a rotation with heavy volumes accumulated there. You can see those volumes nicely with my Volume Profile indicator.

What do those volumes tell us? They tell us that in this place, strong institutional Buyers were absorbing all the selling pressure, and buying everything the Sellers had to sell.

The Buyers were accumulating their Long trades there.

After they entered their huge trading positions they pushed the price into the new uptrend. Now it’s Buyers who is in control and who is pushing the price upwards.

AUD/JPY; 30 Minute chart:

Support at 79.05

What happens when the price returns back into the heavy volume area – the area where those strong Buyers were placing most of their Longs?

Those Buyers will most likely want to defend this place as it is important for them (they placed a lot of their trades there).

So, if the price makes it back to the heavy volume zone around 79.05, then it is likely that those Buyers will use aggressive Market Orders to manipulate the price to go upwards again. That’s how they will defend this zone.

What if those Buyers won’t actively defend this zone anymore? Then there is still a chance this Support will work.

The reason is that the BIG guys (trading institutions) know that this was an important volume-based zone and they will be afraid to try and push through. It would be risky for them to risk a potential fight with strong Buyers.

They rather quit their Short trades if the price comes close to this Support area around 79.05.

Those are the two reasons I think the zone around 79.05 will work as a strong Support.

This trading setup I used here is called the “Volume Profile – Accumulation Setup” and you can learn more about it in my trading course (click the green banner below):

Do you want ME to help YOU with your trading?

I hope you guys liked my analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

- Get link

- Other Apps

- Get link

- Other Apps

Comments

Post a Comment