GOLD: Market Profile and Price Action Analysis

Hello guys,

yesterday we did a Swing trade analysis on USD/CAD. If you missed it then you can check it out here:

USD/CAD: Volume Profile and Price Action Swing Analysis

Today, I am also going to do a Swing trading analysis. This time on Gold!

As I wrote in the yesterday’s post, I do my Swing trade analysis using mostly Daily time frame. Today, I also used 4-Hour time frame.

What initially caught my eye on Gold was the newly formed uptrend that has been on Gold since the start of this month. Big trading institutions are clearly pushing the price of Gold upwards.

GOLD: Volume Profile Analysis

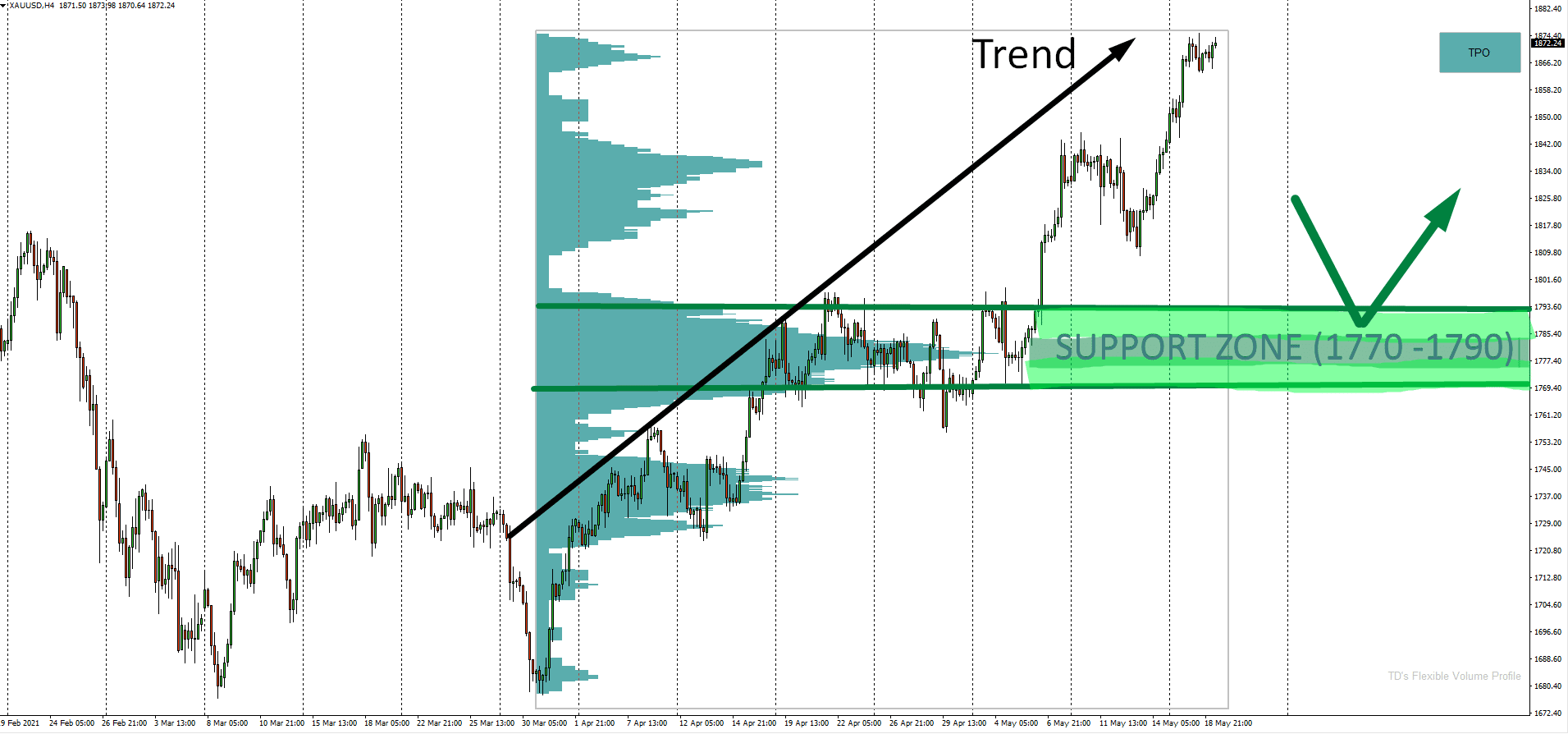

I used my Volume Profile (MT4 Volume Profile) to look into the current uptrend. The Profile showed a significant volume area around 1170 – 1790.

Gold (XAUUSD); 4-Hour time frame:

This is a valuable information because it tells us that strong Buyers used this zone to add to their Long positions. Then they pushed the price even higher.

Even though the price has already left this zone and it is moving above it, this zone is still important. It is so because strong Buyers placed a lot of their Longs there.

If the price comes back, then those Buyers will mostly want to use this zone again – to add to their Longs and to push the price up again.

This is why it should work as a strong Support. Now we just need to wait for a pullback.

The setup I used is called the “Trend Setup“. I like to trade it when there is a trend.

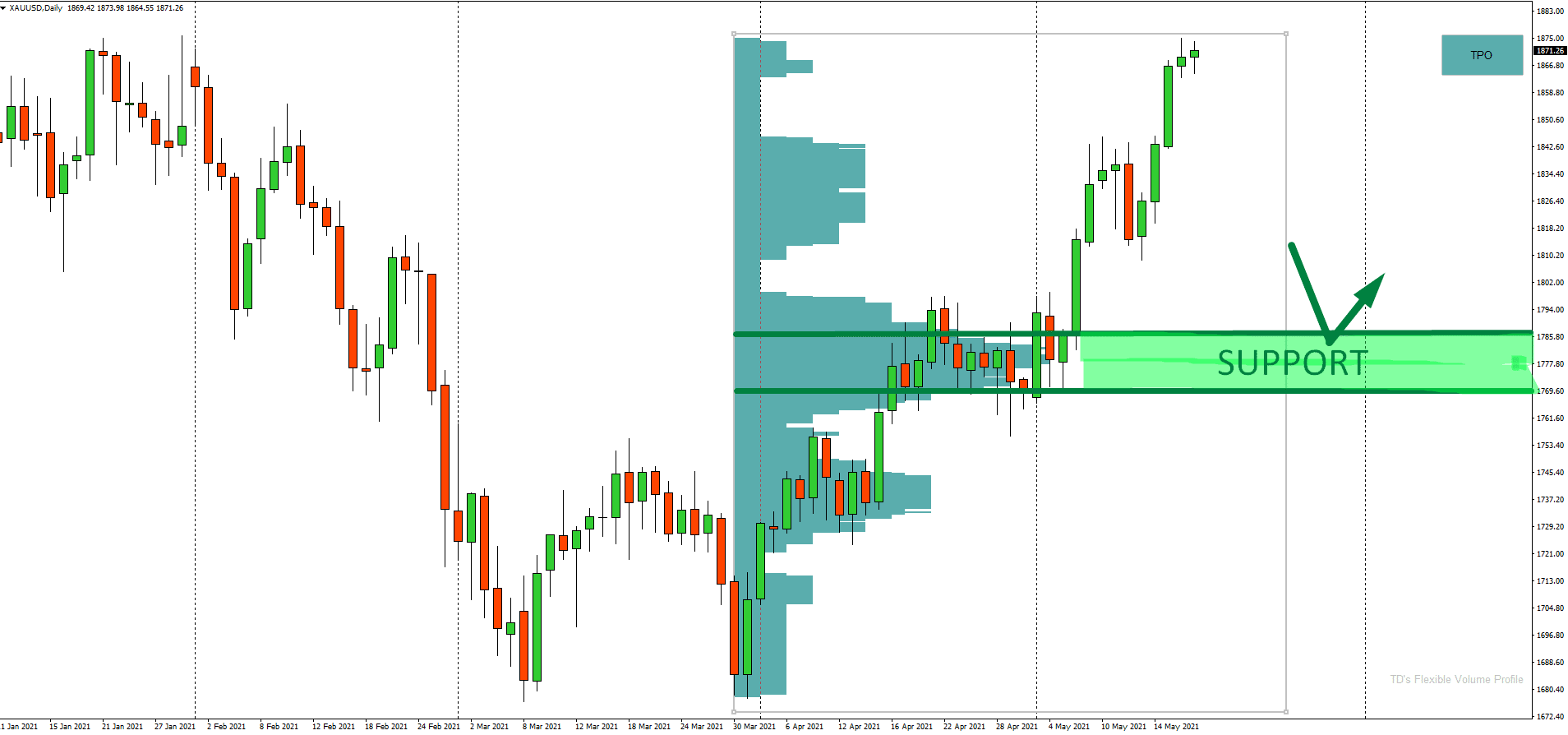

Daily Time Frame

The whole situation is maybe a bit easier to read on a Daily chart. The reason I used 4 Hour chart is that I used TPO Profile. TPO profile is always more detailed and precise if you use it on a faster time frame.

Below is the same situation on a Daily time frame:

If you want to know what is the difference between Volume Profile and TPO (Market Profile) then check out this video:

I hope you guys liked today’s Swing trade analysis! Let me know what you think in the comments below!

Happy trading,

-Dale

Do you want ME to help YOU with your trading?

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment