Hello guys,

the recent macro news started a pretty strong reaction on the EUR. As you may know, the EUR is very closely linked to the CHF currency. This caused the USD/CHF to move as well as the EUR/USD.

In this day trading analysis, I will focus on the USD/CHF.

What I found interesting there is that the price finally broke a price channel, it breached many strong lows, and now moves below them.

Let’s start with Volume Profile analysis and get back to the price action a bit later.

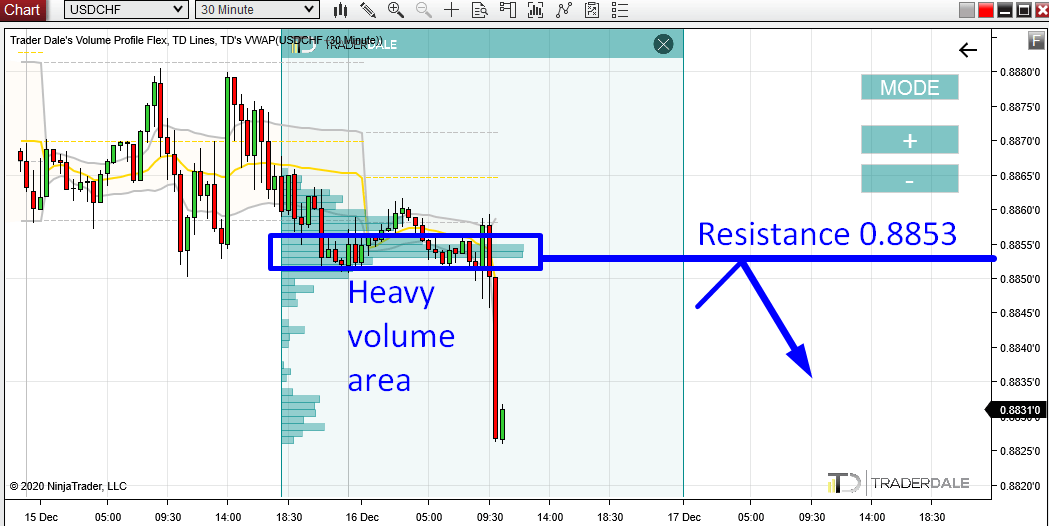

Volume Profile Analysis

Before the strong sell-off started a couple of moments ago, there were quite heavy volumes accumulated. To me, it seems, that sellers were accumulating their Shorts, and then they started to sell aggressively to push the price into a new trend.

The place where the volumes were the heaviest is around 0.8853. That’s the POC and the most important volume zone in this area.

When the price makes it back to this area again it is likely that the price will react to it. The reason is that the big institutions that placed their Shorts around 0.8853 will want to defend this area.

This setup is called the “Volume Accumulation Setup“

USD/CHF; 30 Minute time frame:

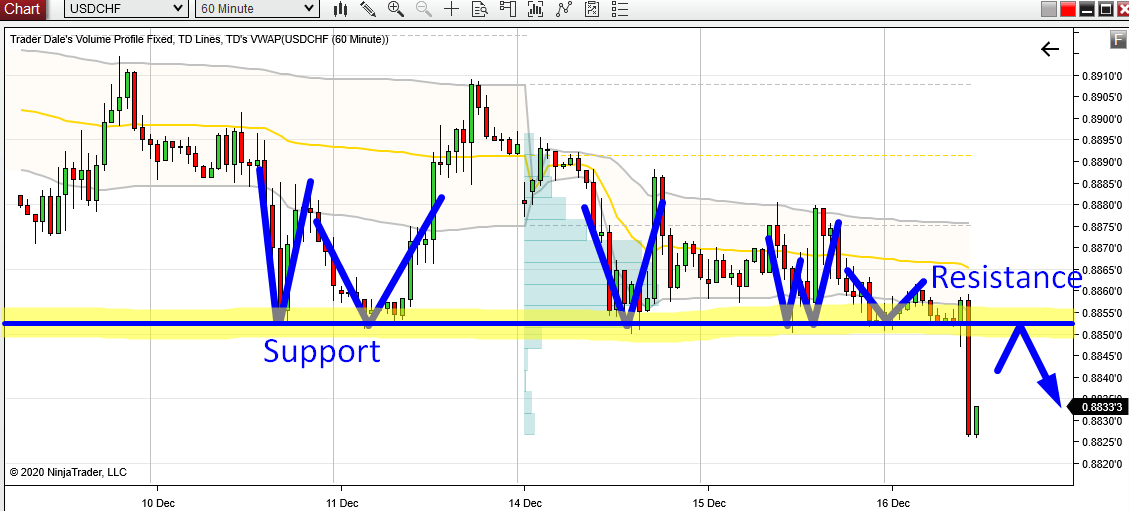

Price Action

In the chart below, I highlighted all the strong reactions to the 0.8853 zone in the past. As you can see it worked as a pretty strong Support! The price bounced off it 5 times! Now, the Support got breached and it turned into a Resistance.

The cool thing is that this nicely aligns with the Volume-based resistance I showed you.

USD/CHF; 60 Minute chart:

Do you want ME to help YOU with your trading?

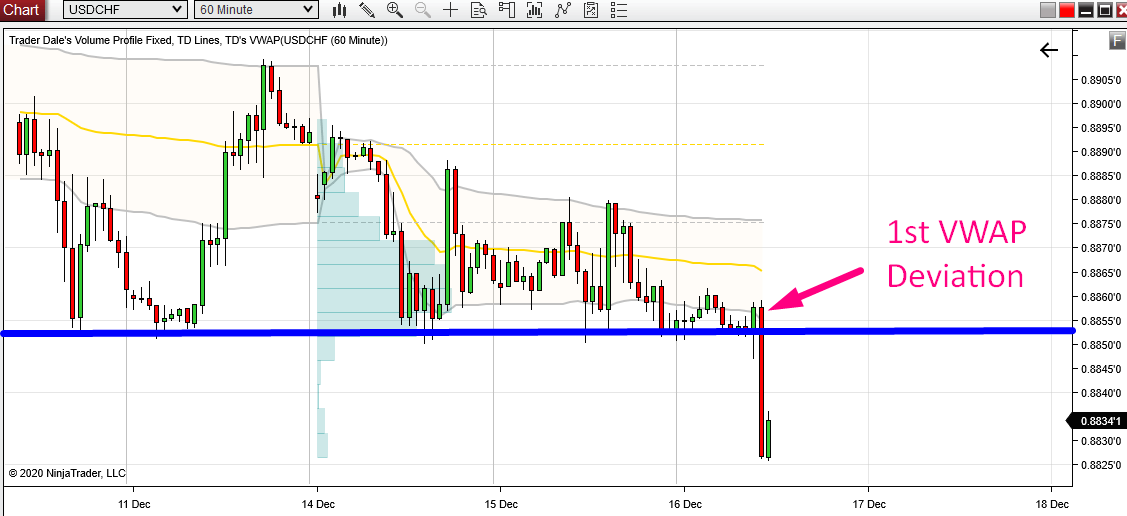

VWAP

There is one more nice little addition to all this. It is a VWAP setup.

The picture below shows a Weekly VWAP with its 1st deviations (the grey lines). Those Deviations work as Support/Resistances.

Currently, the 0.8853 resistance is very close to the lower 1st Deviation. If the price makes it back to this area, while the 1st Deviation is still around, then it will be a nice confirmation of the Resistance.

USD/CHF; 60 Minute chart:

I hope you liked today’s analysis. Let me know what you think in the comments below!

Happy trading!

-Dale

P.S. I have just released a new book called ORDER FLOW: Trading Setups. If you purchase one of my trading courses (now -50% Discounted – Christmas Sale), you will get the book for free!

Volume Profile Course – 50% discount

Order Flow Course – 50% discount

*The book is now EXCLUSIVE to members of my trading courses (not available in any store)

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment