How To Trade The Double Distribution Profile – Volume Profile Trading

Volume Profile histogram has a few basic shapes it can develop into. Their names are based on their looks. We have the “b-shaped profile” which is shaped like a letter “b”, we have a “D-shaped profile”, which looks like the capital letter D, there is also the “p-shaped profile” which looks like the letter “p”, etc…

I talked more in detail about those in the Volume Profile For Beginners Guide.

Today, I would like to talk about the “Double-distribution” profile.

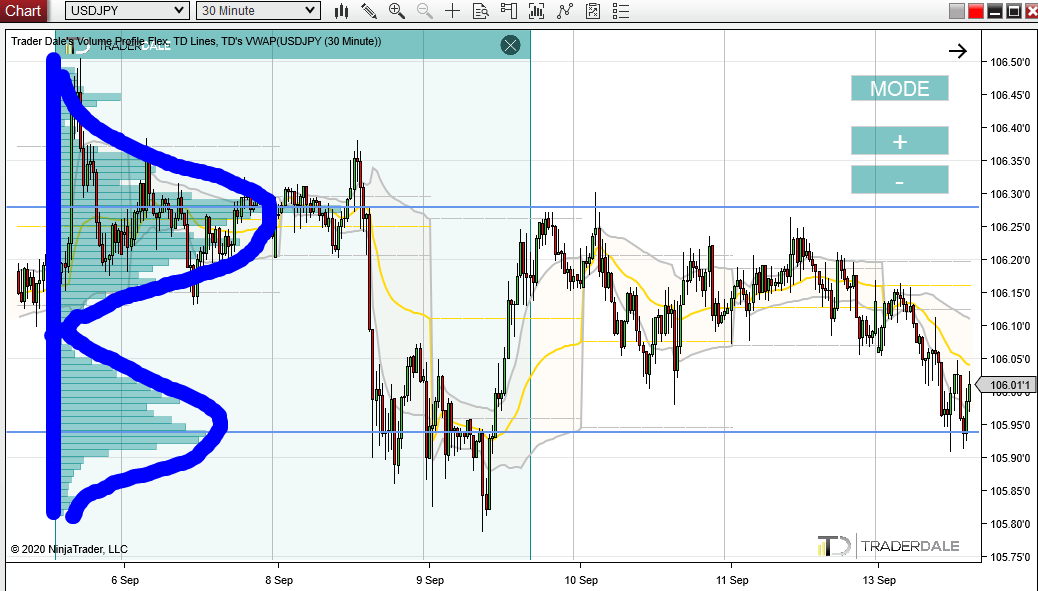

The main feature of this profile shape is that it has two significant volume areas. One at the top, and one at the bottom. Like in the picture below:

“Double distribution” → “D-shaped” profile

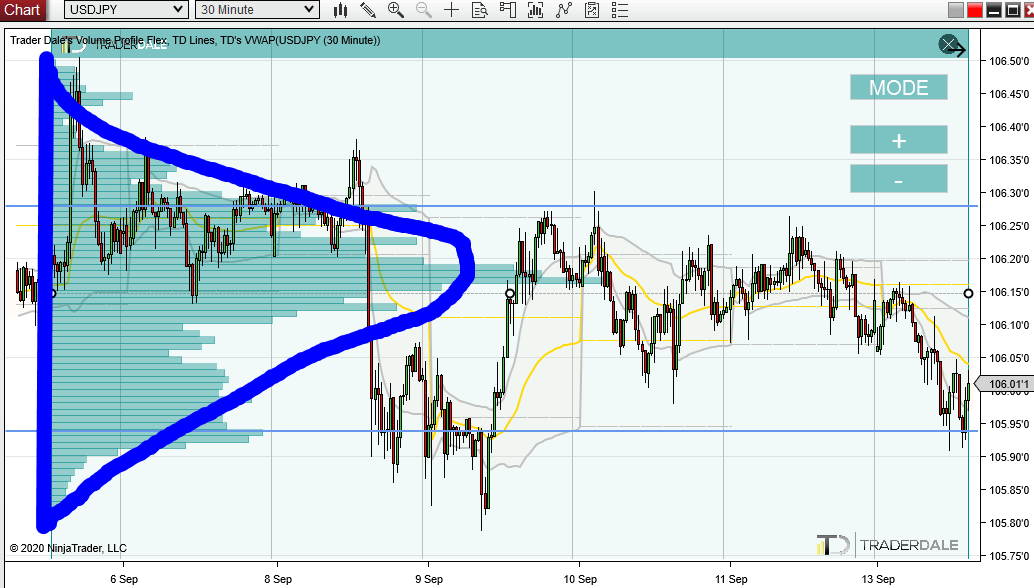

The “Double-distribution” profile very often turns into a “D-shaped” profile. This means that the thin Volume area which is in between of the two heavy volume areas gets filled with volumes.

In order for this to happen, the price needs to react to the two heavy volume areas and bounce off them inwards – towards the center of the “Double-distribution” profile.

The price has a tendency to stay in that center. This is when the heavy volumes get placed there and the “Double-distribution” starts to turn into a “D-shaped profile”. Like here:

How to profit on the “Double-distribution” profile?

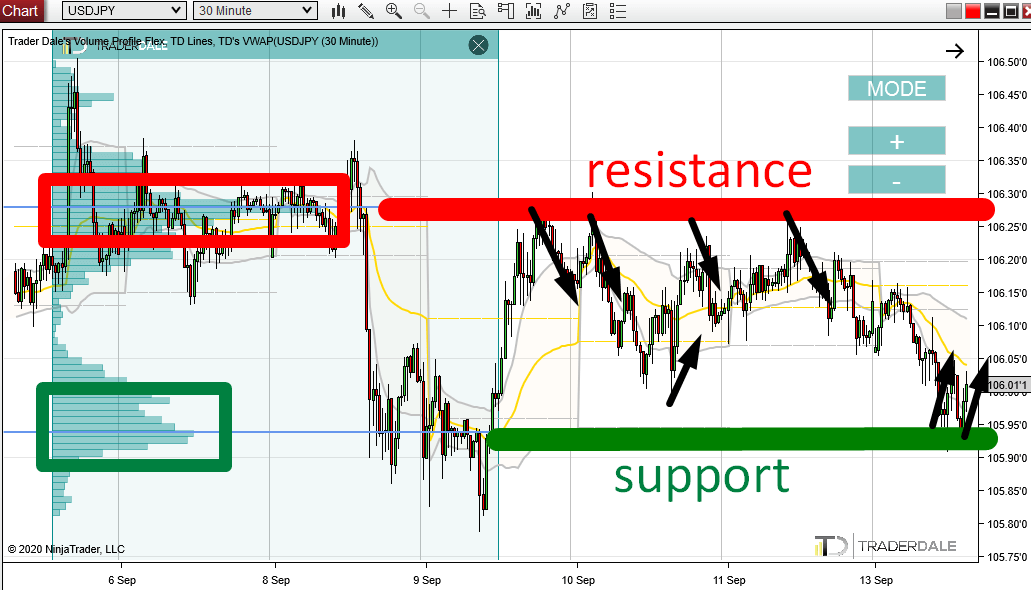

Since the “Double-distribution” tends to transform into “D-shaped” profile, the two heavy volume areas at the top and at the bottom work as Support and Resistance zones. From there the price tends to go inwards towards the center.

That’s how you trade the “Double-distribution” Volume Profile shape: Short from the upper volume zone, and Long from the lower volume zone. Like this:

VIDEO: “Double-distribution” Volume Profile

I had two trading levels on the USD/JPY a few days ago – they were both based on this logic. One was a short from 106.27 and the second one was a long from 105.94.

I published both of those levels in my Members’ area in advance and I also commented on them in my regular Daily levels video.

Below, you can watch the part of the video, where I was talking about the “Double-distribution” profile and about those two trading levels.

Do you want ME to help YOU with your trading?

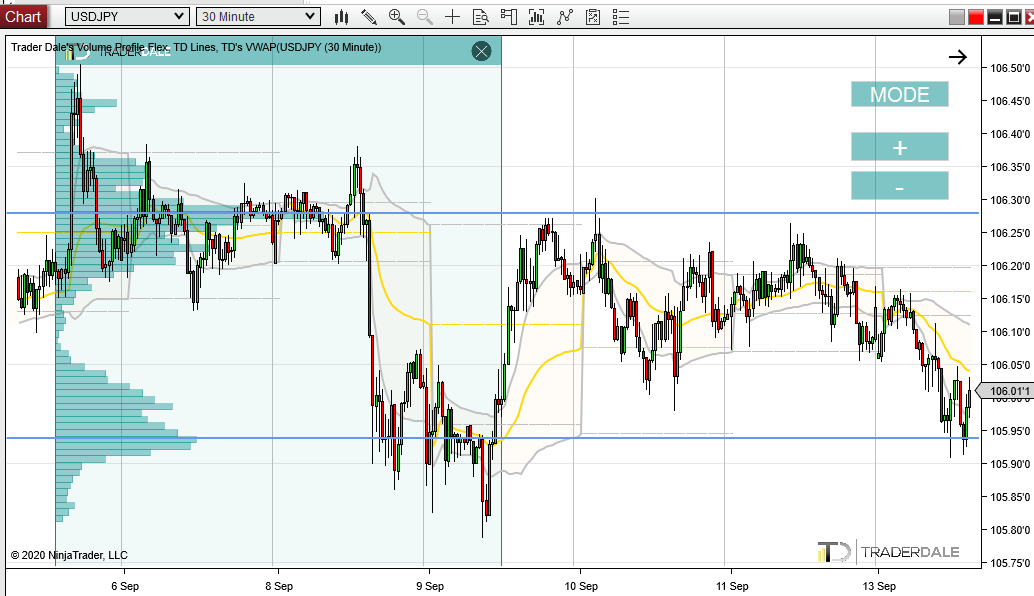

Here is how the price developed after the prediction:

*In this picture I used my Flexible Volume Profile just on the area which was there at the time of my prediction.

As you can see, the price was reacting nicely to the heavy volume zones in the “Double-distribution” profile and was rotating around the center of this area. This slowly turned the “Double-distribution” profile into a “D-shaped” profile:

*In this picture I used my Flexible Volume Profile on the whole area which formed after the reactions to Resistance and Supports and after the “Double-distribution” profile transformed into a “D-shaped” profile.

- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment